Search

Recent comments

- 100.....

2 hours 2 min ago - epibatidine....

7 hours 53 min ago - cryptohubs...

8 hours 51 min ago - jackboots....

8 hours 59 min ago - horrid....

9 hours 7 min ago - nothing....

11 hours 30 min ago - daily tally....

12 hours 52 min ago - new tariffs....

14 hours 44 min ago - crummy....

1 day 8 hours ago - RC into A....

1 day 10 hours ago

Democracy Links

Member's Off-site Blogs

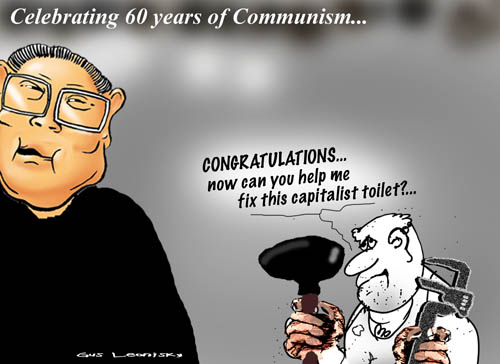

congratulations....

BEIJING — They said there would be blue skies, and blue skies there were, as President Hu Jintao stood erect in his limousine Thursday morning to review the troops and to view the country’s high-tech missiles and tanks at the opening of ceremonies marking China’s 60th anniversary as a republic.

Wearing a Sun Yat-sen suit in honour of the man often called the father of the Chinese republic, Hu greeted an estimated 5,000 soldiers as they stood at attention saying: “Hello, comrades. Work hard.”

After nearly a week of fog and drizzle, it took China’s weather wizards their largest effort yet to deliver the bright blue skies to complement the picture-perfect parade that has been planned and practised in top secret for the past several months.

Although there were no “ordinary” people lining the route to wave flags or to cheer, even on television screens, the goose-stepping soldiers and rolling tanks were a formidable sight as they proceeded down Beijing’s central Chang’an Avenue.

The parade offered the first long look at Chinese military hardware since 1999. Military experts around the world probably won’t be surprised by the 52 new Chinese weapons on display — the missiles, drones and fighter jets — but the home audience is likely to be impressed, and that’s what counts.

----------------------

Meanwhile:

For the first time in history, a communist country is in a position to bring down global capitalism. The Chinese Communist Party, if it were to sell the $763 billion in US Treasury bonds it holds, would trigger a massive devaluation in those bonds and the value of the American dollar, thereby bringing the world economy to its knees.

This situation occurs only 20 years after sledgehammers broke down the Berlin Wall, supposedly heralding the triumph of liberal democracy; and only a decade after the Asian financial crisis, which supposedly proved the superiority of western models of capitalism.

Of course, China's Communism Version 2.0 will do nothing of the sort. The health of China's economy, and ultimately the ability of the Chinese Communist Party to stay in power, depends on the health of global capitalism.

In September 2008, as Japan reduced its exposure to US Treasury bonds by $12 billion, China increased its exposure by $43.6 billion. In the meantime, Chinese leaders have plaintively urged the American government to bolster the US economy and safeguard the value of China's investments.

As the American budget deficit rattles towards $1 trillion, it is China's $2 trillion in foreign-exchange reserves that are seen as the salvation for the world economy.

An often-repeated verse in China these days observes:

In 1921, only socialism could save China.

In 1978, only capitalism could save China.

In 1991, only China could save socialism.

In 2009, only China can save capitalism.

- By Gus Leonisky at 1 Oct 2009 - 10:29pm

- Gus Leonisky's blog

- Login or register to post comments

red flag...

(AFP) – 2 days ago

NEW YORK — New York's iconic Empire State Building will light up red and yellow Wednesday in honor of the 60th anniversary of communist China.

The Chinese consul, Peng Keyu, and other officials will take part in the lighting ceremony which will bathe the skyscraper in the colors of the People's Republic until Thursday, Empire State Building representatives said in a statement.

The upper sections of the building are regularly illuminated to mark special occasions, ranging from all blue to mark "Old Blue Eyes" Frank Sinatra's death in 1998 to green for the annual Saint Patrick's Day.

-------------------

From Gus: Congratulations China.

... and may improvements in socialism be fruitful, peaceful, prosperous and bring better freedom...

accounting in macroeconomics

From the American Conservative

Most of Bruce Bartlett’s new book is an account of American macroeconomic policy from the Great Depression to today. Bartlett offers the valuable perspective of a real inside witness, having served on the staffs of several key members of Congress and as a senior policy analyst in the administrations of Ronald Reagan and George H. W. Bush. He is, moreover, a good economic historian and provides a well-documented summary of the last 80 years of American macroeconomics.

But Bartlett is not a good macroeconomic analyst, and at various points this undermines his case. His most important mistake—one made by many others—is to accept the Keynesian explanation of the Great Depression: “the Fed’s effort to expand the money supply was like pushing on a string,” he says. “Fiscal stimulus was necessary to compensate for the collapse of private spending in the economy and thereby mobilize monetary policy.”

In fact, federal expenditures increased by 47 percent from 1929 to 1933. The 46.1 percent decline in nominal Gross National Product during these years was the result of the Fed’s mistake of reducing M2, the broader money supply, by 30.9 percent at a time of substantial decline in the velocity of money, rather than any inadequate fiscal stimulus.

Economic growth was unusually high from 1933 to 1937, a consequence of a dramatic change in monetary policy that involved increasing the dollar price of gold in 1933, the implementation of deposit insurance in 1934, and a substantial increase in the money supply. Fiscal stimulus was inadequate to prevent the decline in nominal GNP from 1929 to 1933 and unnecessary to increase economic growth from 1933 to 1937.

The same Keynesian perspective leads Bartlett to endorse Obama’s 2009 fiscal stimulus plan. By the time this review is published, however, it will be clear that the initial distribution of the stimulus spending increased private savings but has had no effect on private consumption or investment through the second quarter, and that the recent recession ended long before most of the stimulus expenditures were distributed. Monetary policy was again the most effective macroeconomic policy instrument and was not dependent on a corresponding fiscal stimulus.

To his credit, Bartlett recognizes that Keynesian economics is “mainly a rationale for things that governments everywhere wanted to do anyway.

--------------------------

Read more of this book review at the American Conservative.

from Gus: MEANWHILE, methink, as hinted earlier. that while most economists were basking in the glow of a seemingly "booming economy", someone somewhere was white-anting the system for huge profit while spruiking the solidity of the edifice. And as in any white-ant colonies, there is a queen enjoying royal treatment and workers doing the dirty work... These workers actually were CEOs of Banks and financial institutions — all promised oodles of cash bonus to sink their teeth into — while the core of the economic system was being hollowed out, leaving a veneer of confidence on which the economists and government planners were resting confidently.

The difference between Australia's present sucess — that has led to an increase in interest rate yesterday (07/10/09) — and the rest of the world (still in the dumps) resides in the personal tax break that was mostly democratically distributed equally ($900 value for all), regardeless of earnings — except for those earning more than 150,000 and those who did not qualify for specific reason. This Government rescue bonus took the banks out of the leeching loop and placed the rescue package directly into the pockets of the citizens. The banks had been protected by stringent regulations that they might have objected to in the past but, in Australia, it saved their bacon — thus the banks did not need any rescue moneys, except a government guaranty of ALL people's savings.

Of course those who are loaded to the rafters did not want the populace get this extra $900 in everyone's pocket... claiming "deficit deficit...". Yet that deficit helped many of the strugglers — who would have been struggling some more harder — get on their feet and be innovative too.

see toon at top...