Search

Recent comments

- he can't write....

45 min 26 sec ago - free-ish

55 min 8 sec ago - blame....

1 hour 24 sec ago - EU plays games....

4 hours 45 min ago - FBI in kiev.....

9 hours 56 min ago - iraq oil theft...

10 hours 22 min ago - godly friends of zionist war...

11 hours 2 min ago - pax amercanus....

13 hours 3 min ago - bondi.....

21 hours 6 min ago - defection....

1 day 8 hours ago

Democracy Links

Member's Off-site Blogs

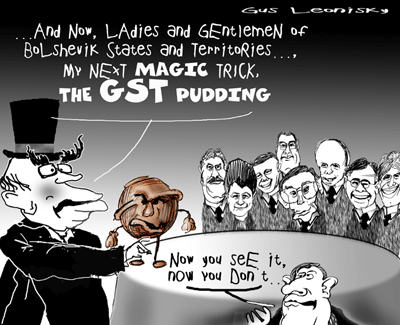

Magic Trick

- By Gus Leonisky at 3 Apr 2005 - 4:43pm

- Gus Leonisky's blog

- Login or register to post comments

welcome to the tax...

from the American Conservative...

One of President Obama's top economic advisers, former Fed chief Paul Volcker, sug gested this week that it's time for America to adopt a VAT, or value-added tax. The White House yesterday downplayed the idea -- but it's sure to resurface: It's an inevitable consequence of a government that's too big now and likely to grow even bigger thanks to Washington's reckless spending spree.

Don't get me wrong: The VAT -- on top of all the other taxes Washington imposes -- is a terrible idea. Imposing it would pretty well finish the transformation of our country into a European-style slow-growth nation. The right way to close Uncle Sam's gaping deficits is to reverse the continued explosion of federal spending.

The VAT is a type of national sales tax, levied on the value-added at each stage of production. Consider a piece of furniture: The VAT would be imposed when the raw timber is sold, when the sawmill produces lumber, when the manufacturer builds a chair, a tax at the wholesaler level and then when a retailer sells the chair to a consumer.

To avoid double taxation, each seller along the way gets a credit for taxes paid at earlier stages of the production process. So the final tax to the consumer, at least in theory, is the same as a retail sales tax of the same amount.

The VAT has its virtues: As a single-rate, consumption-based system, much like the flat tax or national sales tax, it would introduce far fewer economic distortions than today's income tax -- and a heckuva lot less paperwork.

----------------------

Gus: Yeahhh... Here in Orstralya, the GST which is a VAT (a tax on the added value of goods and services) is a boon for governments... I am quite impressed that so far they have managed to restrain it to 10 per cent on top of the added value, thus it's still easy to calculate. Just wack 10 per cent on the bill and when deducting the tax from the business expenditure divide the total by 11... Whoopsydoo. In some countries the tax has been fiddled with and has climbed to 22 per-cent-added-whopper, which when deducing from costs ends up having to ask a fully fledged mathematician, especially when it reaches figures like 16.8 per cent on the added value. But VAT has advantages... First, everyone PAYS TAX... No loophole where you can escape... You buy, you pay tax... Unless you pay cash, with no receipt... But we live in the era of the plastic fantastic thus most transactions are recorded for tax posterity.

The problem for the Yanks is the array of state taxes and states budgets that could make implementing a uniformed VAT very difficult...

see toon at top... It was drawn when our conservative Australian federal government implemeted the GST (VAT) to the horror of Labor states...

Liars depend on the limitations of memory.

Good one Gus.

How well I remember the manner in which the Howard "New Order" introduced the largest single tax in Australia's history - the GST. We are still treated to the lie by omission of the media when the "Mad Monk" and that troglodyte conservative Bronwyn Bishop when they claim that the Coalition are the "low tax" party in Australia's Parliament. Fair dinkum.

The short history of that sham was when the Democrats decided to vote against the GST and in the process dropped Meg Lees as their leader. I guess "in a rit of fealous jage" [Peter Sellers] she lumped all Australians with that tax on virtually everything - and against her party. Nice politician that. In so doing she destroyed the Don Chipp party of "keeping the bastards honest". IMHO a sad loss.

This GST was Howard's answer to Margaret Thatcher's VAT which crippled the British economy for years after. However, Howard had a base on which he could increase overall taxes without the permission of the Senate IF he was in government?

The question in my mind is that, since the neo-cons have laid the ground rules in introducing a tax which Costello said would be "in our National interests" - what if Kevin Rudd uses that tax, as Howard intended, and increases it to handle some of the cost of Australia's plans for the future? Interesting debate?

The previous Labor PM of New Zealand did it and the Coalition's recently "side swiped" Shadow Minister for Finances Barnaby Joyce said that their economy is better than ours. Struth.

IMHO if Kevin Rudd doesn't do it - any future conservative government will.

God Bless Australia and let's hope that the festering remnants of Howard's "New Order" all lose their seats at the next election. NE OUBLIE.