Search

Recent comments

- war criminals.....

39 min 43 sec ago - aussieoil.....

1 hour 29 min ago - sobering....

2 hours 12 min ago - iran's....

3 hours 43 min ago - blind interceptors....

4 hours 2 min ago - ARTIFINTEL....

5 hours 41 min ago - don't mention it....

6 hours 40 min ago - fear godot....

6 hours 44 min ago - no regeem change....

7 hours 30 min ago - blind maddow....

7 hours 40 min ago

Democracy Links

Member's Off-site Blogs

all the way to the bank

As a reminder of the unchastened status quo, Blankfein remains the gift that keeps on giving.

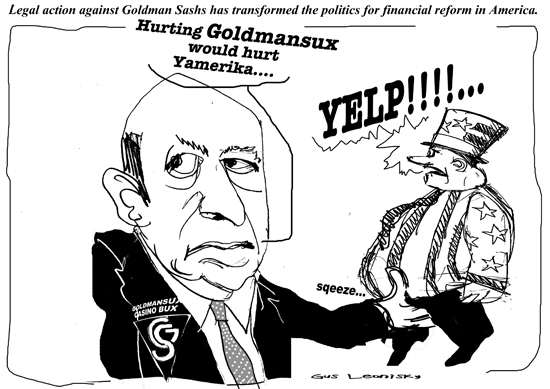

On Thursday, The Financial Times reported that he had been calling clients to argue that the S.E.C. case against Goldman would ultimately “hurt America.” The opposing point of view was presented by Ira Glass on his radio show “This American Life” this month. With reporters from the nonprofit journalistic organization ProPublica, it told the story of another hedge fund, Magnetar, that gamed the housing bubble. Bankers who worked on Magnetar deals walked away with their huge bonuses well before disaster struck — or, as the program put it, “bankers made money even when they were buying things that eventually blew up the bank.” Not to mention the economy. And it was all legal.

To award the audience a bonus, “This American Life” concluded with a Broadway song commissioned from a co- author of the satirical musical “Avenue Q.” Titled “Bet Against the American Dream,” it distills a complex financial saga to its essence: Those who shorted the housing market shorted the country.

Go online, listen to it and laugh. But the fact remains that those who truly hurt America are laughing harder still, all the way to the bank.

- By Gus Leonisky at 26 Apr 2010 - 8:08pm

- Gus Leonisky's blog

- Login or register to post comments

the end game is... to make money...

The farcical spectacle of the Republican retreat has been particularly enjoyable. It was only last Sunday that Senator Mitch McConnell went on CNN to flog his big lie that the Senate reform bill somehow guaranteed bank bailouts — a talking point long ago concocted for the G.O.P. by its favorite spin strategist, Frank Luntz. McConnell’s House counterpart, John Boehner, was meanwhile waging a campaign to portray the Democrats as shills for Goldman, a major source of Obama donations and personnel. Never mind that the Bush White House chief of staff, Joshua Bolten, was a Goldman alumnus and that both McConnell andBoehner had voted for the very bailouts they now profess to abhor (a k a TARP) after a sales job by Henry Paulson, the Bush Treasury secretary who was Blankfein’s predecessor as Goldman’s C.E.O.

http://www.nytimes.com/2010/04/25/opinion/25rich.html?ref=homepage&src=me&pagewanted=print

BS AAA rated...

Let’s hear it for the Senate’s Permanent Subcommittee on Investigations. Its work on the financial crisis is increasingly looking like the 21st-century version of the Pecora hearings, which helped usher in New Deal-era financial regulation. In the past few days scandalous Wall Street e-mail messages released by the subcommittee have made headlines.

That’s the good news. The bad news is that most of the headlines were about the wrong e-mails. When Goldman Sachs employees bragged about the money they had made by shorting the housing market, it was ugly, but that didn’t amount to wrongdoing.

No, the e-mail messages you should be focusing on are the ones from employees at the credit rating agencies, which bestowed AAA ratings on hundreds of billions of dollars’ worth of dubious assets, nearly all of which have since turned out to be toxic waste. And no, that’s not hyperbole: of AAA-rated subprime-mortgage-backed securities issued in 2006, 93 percent — 93 percent! — have now been downgraded to junk status.

What those e-mails reveal is a deeply corrupt system. And it’s a system that financial reform, as currently proposed, wouldn’t fix.

The rating agencies began as market researchers, selling assessments of corporate debt to people considering whether to buy that debt. Eventually, however, they morphed into something quite different: companies that were hired by the people selling debt to give that debt a seal of approval.

Those seals of approval came to play a central role in our whole financial system, especially for institutional investors like pension funds, which would buy your bonds if and only if they received that coveted AAA rating.

sugar coated pill...

By LOUISE STORY

Lloyd C. Blankfein, Goldman Sachs’s chief executive, plans to tell lawmakers on Tuesday that the day the Securities and Exchange Commission accused his firm of securities fraud was “one of the worst days” in his life.

According to his prepared testimony, released on Monday by Goldman, Mr. Blankfein plans to strike his most conciliatory tone yet, saying that he supports financial regulatory reform and arguing that his bank and others provide an important economic function, helping to manage money for pension funds and others and helping to distribute capital to companies.

“These functions are important to economic growth and job creation,” Mr. Blankfein plans to say. “I recognize, however, that many Americans are skeptical about the contribution of investment banking to our economy and understandably angry about how Wall Street contributed to the financial crisis.”

Goldman’s role in the financial crisis will be at the center of a hearing on Tuesday by the Senate’s permanent subcommittee on investigations. That committee released e-mail messages over the weekend in which Mr. Blankfein and other executives discussed the firm’s bet against mortgages in 2007, just as the housing market began to fall apart.

In his prepared testimony, Mr. Blankfein insisted — as the firm did over the weekend — that Goldman was not significantly shorting the market.

“We didn’t have a massive short against the housing market and we certainly did not bet against our clients,” Mr. Blankfein plans to say. “Rather, we believe that we managed our risk as our shareholders and our regulators would expect.”

-------------------------------

upset banksters...

A revolt among big donors on Wall Street is hurting fundraising for the Democrats' two congressional campaign committees, with contributions from the world's financial capital down 65 percent from two years ago.

The drop in support comes from many of the same bankers, hedge fund executives and financial services chief executives who are most upset about the financial regulatory reform bill that House Democrats passed last week with almost no Republican support. The Senate expects to take up the measure this month.

This fundraising free fall from the New York area has left Democrats with diminished resources to defend their House and Senate majorities in November's midterm elections. Although the Democratic Senatorial Campaign Committee and the Democratic Congressional Campaign Committee have seen just a 16 percent drop in overall donations compared with this stage of the 2008 campaign, party leaders are concerned about the loss of big-dollar donors. The two congressional committees have raised $49.5 million this election cycle from people giving $1,000 or more at a time, compared with $81.3 million at this point in the last election.

Almost half of that decline in large-dollar fundraising can be attributed to New York, according to a Washington Post analysis of records filed with the Federal Election Commission. Donors from that area have given $8.7 million this year, compared with $23.9 million at this point in the 2008 cycle, with most of those contributions coming from big contributors in the financial sector. New York donors had given congressional Democrats almost twice as much money at this stage of the 2006 midterm campaigns, when Republicans ruled both chambers and held the White House.

Reasons for the plummeting donations include concern about the economic recovery and the personalities of the campaign committee leaders, Democratic experts say. But the overwhelming factor is the rising anger among financial executives who think they have not been treated well based on their support of Democrats over the past four years, according to lawmakers, party strategists and fundraisers. Several of the party's biggest New York donors declined through spokesmen to be interviewed. Some Democrats say pushing Wall Street reform is more important than any slippage in political donations.

"Democrats worked hard to pass reform with tough oversight, accountability and regulation, and it's no secret the big banks were against it," said Deirdre Murphy, spokeswoman for the Democratic Senatorial Campaign Committee. "But we believe preventing another financial collapse is the responsible thing to do, and at the end of the day, we will have the resources we need to compete in our targeted states, as will our candidates."