Search

Recent comments

- no shipping.....

8 hours 46 min ago - digging graves....

8 hours 58 min ago - BS draft...

9 hours 6 min ago - tankers ablaze....

9 hours 52 min ago - shoes....

11 hours 51 min ago - new map....

12 hours 25 min ago - weapongeddon....

12 hours 42 min ago - squirming....

12 hours 58 min ago - UK kills russians...

17 hours 39 min ago - fury shit....

17 hours 49 min ago

Democracy Links

Member's Off-site Blogs

meanwhile in the greasepan...

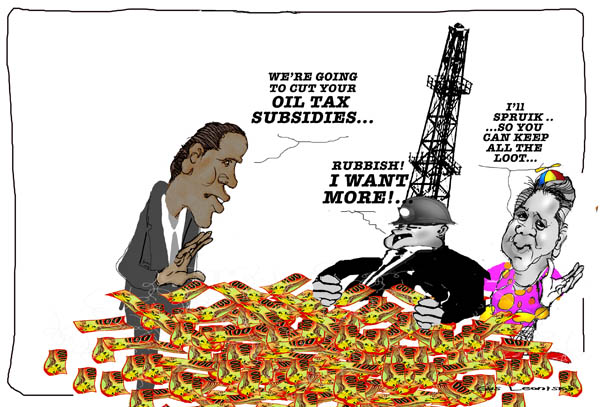

As Oil Industry Fights a Tax, It Reaps Billions From Subsidies

When the Deepwater Horizon drilling platform set off the worst oil spill at sea in American history, it was flying the flag of the Marshall Islands. Registering there allowed the rig’s owner to significantly reduce its American taxes.

The owner, Transocean, moved its corporate headquarters from Houston to the Cayman Islands in 1999 and then to Switzerland in 2008, maneuvers that also helped it avoid taxes.

At the same time, BP was reaping sizable tax benefits from leasing the rig. According to a letter sent in June to the Senate Finance Committee, the company used a tax break for the oil industry to write off 70 percent of the rent for Deepwater Horizon — a deduction of more than $225,000 a day since the lease began.

With federal officials now considering a new tax on petroleum production to pay for the cleanup, the industry is fighting the measure, warning that it will lead to job losses and higher gasoline prices, as well as an increased dependence on foreign oil.

But an examination of the American tax code indicates that oil production is among the most heavily subsidized businesses, with tax breaks available at virtually every stage of the exploration and extraction process.

According to the most recent study by the Congressional Budget Office, released in 2005, capital investments like oil field leases and drilling equipment are taxed at an effective rate of 9 percent, significantly lower than the overall rate of 25 percent for businesses in general and lower than virtually any other industry.

And for many small and midsize oil companies, the tax on capital investments is so low that it is more than eliminated by various credits. These companies’ returns on those investments are often higher after taxes than before.

“The flow of revenues to oil companies is like the gusher at the bottom of the Gulf of Mexico: heavy and constant,” said Senator Robert Menendez, Democrat of New Jersey, who has worked alongside the Obama administration on a bill that would cut $20 billion in oil industry tax breaks over the next decade. “There is no reason for these corporations to shortchange the American taxpayer.”

http://www.nytimes.com/2010/07/04/business/04bptax.html?_r=1&hp=&pagewanted=print

- By Gus Leonisky at 4 Jul 2010 - 6:15pm

- Gus Leonisky's blog

- Login or register to post comments

the distorted "price" of stuff...

Mr. Menendez said he believed the Gulf spill was devastating enough to spur Congress into action. But one notable omission in his bill shows the vast economic reach of the industry. While the legislation would cut many incentives over the next decade, it would not touch the tax breaks for oil refineries, many of which have operations and employees in his home state, New Jersey.

Mr. Menendez’s aides said the senator thought it was legitimate to allow refineries to continue claiming a manufacturing tax credit that he wants to eliminate for drillers because refining is a manufacturing business and because refineries do not benefit from high oil prices. Mr. Menendez did not consult with New Jersey refineries when writing the bill, his aides said.

-------------

Gus: in the end the price at the pump is lower than what it should be... It's good for the "consumer", except the "consumer" pays for it in some other ways like giving tax concessions to the big oil... which takes a cut of the loot everytime the till rings with subsidies... It's perverse, but it also keep some of the workers employed but with less real money but, since the price of gas at the pump is lower, they don't need "more"... etc... Perverse cycle in which a few well-placed geezers collect dues from every steps of the subsidy racket...