Search

Recent comments

- escalationing....

9 hours 54 min ago - not happy, john....

14 hours 14 min ago - corrupt....

19 hours 35 min ago - laughing....

21 hours 29 min ago - meanwhile....

22 hours 58 min ago - a long day....

1 day 52 min ago - pressure....

1 day 1 hour ago - peer pressure....

1 day 16 hours ago - strike back....

1 day 17 hours ago - israel paid....

1 day 18 hours ago

Democracy Links

Member's Off-site Blogs

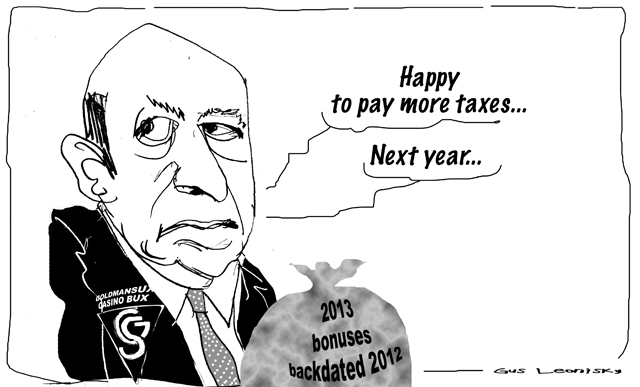

good timing...

"The December delivery of shares went to a wider group of employees than the named executive officers [who were included in the filings]," said Michael DuVally, a spokesman for the New York-based firm. He declined to comment on the reason for the accelerated delivery or on which other employees received stock early.

Blankfein, 58, has said he would be willing to pay higher taxes if they were part of a fiscal compromise to reduce the budget deficit. He praised the bill that passed the House of Representatives.

Read more: http://www.smh.com.au/business/world-business/goldman-sachs-jumps-to-avoid-fiscal-cliff-20130103-2c6ad.html#ixzz2GsCx6ZEo

- By Gus Leonisky at 3 Jan 2013 - 12:10pm

- Gus Leonisky's blog

- Login or register to post comments

delayed catastrophe...

‘Fiscal cliff’ deal does little to tame threats from debt ceiling, high unemployment rates

By Zachary A. Goldfarb, Published: January 2The deal to which the House gave final approval late Tuesday will head off the most severe effects of the “fiscal cliff” by averting a dangerous dose of austerity but still leaves the economy vulnerable to both immediate and more distant threats.

The agreement, which the Senate approved only hours after the government hit the limit on federal borrowing, fails to defuse the prospect of a catastrophic national default two months from now. The deal does not raise the debt ceiling, leaving the Treasury to use what it calls “extraordinary measures” as long as it can to pay the government’s bills.

read more: http://www.washingtonpost.com/business/fiscal-cliff/fiscal-cliff-deal-does-little-to-tame-threats-from-debt-ceiling-high-unemployment-rates/2013/01/01/8e4c14aa-5393-11e2-bf3e-76c0a789346f_print.html

yes and no...

Goldman Sachs has been forced into an embarrassing climbdown from plans to allow its highly paid bankers to avoid the 50% top rate of tax, following public intervention by Bank of England governor Sir Mervyn King and pressure from the government.

But the Wall Street firm is expected to spark a fresh row over City bonuses on Wednesday by revealing that its bankers have enjoyed a 10% pay rise when it announces profits for 2012.

Goldman was already facing condemnation about proposals to defer bonuses until after 6 April, when the top rate of income tax falls to 45% from 50%, when King waded in. The Bank of England governor told MPs he regarded such attempts as "depressing".

Further pressure was being exerted behind the scenes by the Treasury minister, Sajid Javid, who spoke to Goldman bankers to seek assurances that the bonuses from 2009, 2010 and 2011 would not be delayed.

http://www.guardian.co.uk/business/2013/jan/15/mervyn-king-goldman-sachs-bonus-row/print