Search

Recent comments

- peer pressure....

8 hours 30 min ago - strike back....

8 hours 36 min ago - israel paid....

9 hours 38 min ago - on earth....

14 hours 8 min ago - distraction....

15 hours 19 min ago - on the brink....

15 hours 28 min ago - witkoff BS....

16 hours 42 min ago - new dump....

1 day 4 hours ago - incoming disaster....

1 day 4 hours ago - olympolitics.....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

at the markets of sanctions and rotten tomatoes...

EU.

EU.

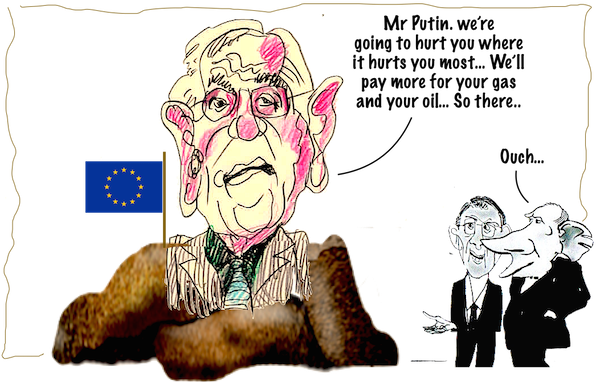

The EU has agreed to impose new anti-Russia sanctions in retaliation to Moscow’s decision to recognize the breakaway republics in eastern Ukraine. These range from limiting access to European financial markets to targeting individual officials behind the move, the EU’s top diplomat Josep Borrell said on Tuesday.

The upcoming sanctions “will hurt Russia and will hurt a lot,” the EU High Representative for Foreign Affairs said in Paris, speaking alongside France's Foreign Minister Jean-Yves Le Drian. Accusing Moscow of committing “grave violations,” Borrell said neither the recognition of Donetsk (DPR) and Lugansk (LPR) People’s Republics, nor further steps by Russia in Ukraine, will go “unanswered.”

The EU would target 27 individuals and entities, allegedly involved in undermining the integrity of Ukraine, Borrell said. The bloc will also sanction all the 351 members of the Russian parliament, the State Duma, who voted in favor of recognizing the two republics.

Read more:

https://www.rt.com/russia/550292-eu-sanctions-borrell-donbass/

• Oil prices jump, nearing $100 a barrel, as Ukraine developments roil energy markets.

European gas futures spiked 13 percent after Russia ordered troops into separatist territories in Ukraine.

• Germany puts a stop to Nord Stream 2, a key Russian natural gas pipeline.

• Stocks fall as Western governments announce sanctions against Russia.

• Fed officials firm up plans for a swift pullback of economic help.

• For the Fed, Ukraine is yet another inflation uncertainty.

• Big banks are keeping a close eye on Russia-Ukraine tensions.

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!!!!!!!!!!!!!!

- By Gus Leonisky at 23 Feb 2022 - 11:40am

- Gus Leonisky's blog

- Login or register to post comments

putin did not invade ukraine...

... nor further steps by Russia in Ukraine, will go “unanswered.”

Okay, let me explain. Before having "peacekeepers" — or whatever you want to call them — in the two new republics, Putin made sure that they were independent by choice, like Ireland did by force in the 1920s, of the people who live there. END OF STORY. Once these are not part of England... er sorry, Ukraine, Putin's army can help with the defence of the new republics. HELLO? Yes. Putin did not invade Ukraine... The Irish in Ireland should be proud they showed the way...

Oh and by the way, Ukraine was encircled by Russian troops doing "some manoeuvres".

Okay. Let me explain. Had Putin not prepared the ground — not for an invasion of Ukraine (as the NATO Western idiots have been claiming) — NATO FORCES WOULD HAVE INVADED UKRAINE and rushed to help the Azov Nazi troops to push back the Russians in the two new republics. But with the Russian troops "everywhere", the NATO forces would have been defeated like rabbits being shot in a barrel.

The unilateral declaration by the Douma was essential for Putin to act. Had Ukraine rspected the terms of the Minsk Agreements, Putin would have done nothing.... Most of the sanctions by the USA are designed to hurt EUROPE for not helping out. The sanctions from Europe against Russia are going to hurt Europe badly. At any time, (but he won't do it because he is smarter than the average bear), Putin could shut gas to Europe — and the Europeans know it. This would collapse Wall Street for a few days and make the European freeze their arse off, which Putin considers kindly anyhow.

But as Thierry Meyssan proposes, the next stage of the caper is TRANSNISTRIA... We shall see...

swift oil market...

If Western sanctions lead to Russia’s oil exports being completely cut off, the world can expect the international energy market to collapse, a senior figure at the American rating agency Fitch said on Tuesday.

Speaking in an interview with Russian news agency TASS, Dmitry Marinchenko explained that the current spike in oil prices would be mitigated if there is no further escalation around Ukraine. However, a further ramping up of tensions could be a disaster.

Marinchenko is the senior director of the Natural Resources Group at the American rating agency.

“The geopolitical surplus of the price of oil now is about $15 per barrel,” Marinchenko explained. “If everything goes according to the calmest scenario, which implies no further escalation, minimal sanctions that do not affect the oil and gas sector, and the freezing of the conflict, this geopolitical surplus will come to naught.”

In a more pessimistic scenario, where the escalation around Ukraine intensifies even further, and Western nations impose severe sanctions on the Russian energy sector, Marinchenko suggested that the price of oil could exceed $100 per barrel. According to the expert, this will result in an energy crisis.

The analyst from Fitch explained the worst-case-scenario forecast by explaining that no other nation can replace Moscow’s exportation of natural resources.

“Russia’s share in the world oil market is more than 10%. There is nothing to replace it. There is little free capacity, especially considering the gradual recovery in demand,” he clarified.

On Monday, following Russia’s decision to recognize the independence and sovereignty of the breakaway Donetsk and Lugansk People’s Republics, the US and EU announced that they would impose new sanctions on Moscow. The White House, however, emphasized that the measures are unlikely to target Russia’s energy exports. Washington also said that the initial package of anti-Russian measures would not include the restriction of Moscow’s access to SWIFT, the world’s leading international financial transactions system.

READ MORE:

https://www.rt.com/russia/550264-western-sanctions-oil-crisis/

\

Europeans will soon have to pay €2,000 ($2,200) per thousand cubic meters of natural gas, former Russian president and current deputy chairman of the Security Council Dmitry Medvedev tweeted on Tuesday. The warning comes after Germany ordered a halt to Nord Stream 2 gas pipeline certification.

“German Chancellor Olaf Scholz ordered to stop the certification of the Nord Stream 2 gas pipeline. Well, welcome to the new world, in which Europeans will soon pay €2,000 per thousand cubic meters of gas!” Medvedev wrote in a half-ironic Twitter post.

Earlier on Tuesday, Chancellor Scholz said that the German government was stopping the months-long certification process of the Russia-backed Nord Stream 2 pipeline project in light of the current standoff between Russia and Ukraine over the Donbass regions.

Late on Monday, Russia officially recognized the Donetsk and Lugansk People's Republics of the breakaway region, sparking criticism from Western countries and claims that Russia is attempting to unlawfully invade Ukraine.

Chancellor Scholz said he had asked the German economy ministry to make sure the pipeline’s certification could not take place at the moment.

READ MORE:https://www.rt.com/business/550254-europe-gas-price-double/At double the price, Russian gas is STILL 60 % CHEAPER than the US gas...

READ FROM TOP.

Please be aware THAT PUTIN IS AWARE OF ALL THIS. SO IS XI...

FREE JULIAN ASSANGE NOW...

scheisse! trump thinks like gus!...

Trump praises Putin

Former US President ripped Biden’s handling of Ukraine crisis, calling Russia’s Donbass move ‘genius’

Former President Donald Trump has praised Russia’s Vladimir Putin for his strategy in eastern Ukraine, arguing that the Russian leader outmaneuvered Joe Biden by declaring the breakaway republics of Donetsk (DPR) and Lugansk (LPR) to be sovereign states.

“I went in yesterday, and there was a television screen, and I said, ‘This is genius,’” Trump told radio host Buck Sexton in an interview on Tuesday. “Putin declares a big portion of the Ukraine – of Ukraine — Putin declares it as independent.” He added sardonically, “Oh, that’s wonderful.”

Trump was referring to President Putin’s announcement on Monday that Russia would immediately recognize the sovereignty of DPR and LPR, which declared their independence after a US-backed overthrow of Ukraine’s elected leadership in 2014. Putin followed up that decision by getting lawmaker approval on Tuesday to send Russian forces into the Donbass as peacekeepers for DPR and LPR. The Russian leader, however, later clarified that the authorization does not mean Russian troops would be deployed to the republics immediately.

The former US commander-in-chief said such a turn of events never would have happened if he were still in office, accusing his predecessor of incompetence while referring to Russia’s Donbass move, including Moscow’s potential peacekeeping mission as “smart.”

“That’s the strongest peace force -- we could use that on our southern border,” Trump quipped. “That’s the strongest peace force I’ve ever seen. There were more army tanks than I’ve ever seen. They’re going to keep peace all right.”

Biden on Tuesday announced economic sanctions against Moscow and deployments of US forces in the Baltic region in response to what he called “the beginning of a Russian invasion of Ukraine.”Trump argued that Russia is essentially grabbing territory without serious repercussions, which he said was due to Putin being a “savvy guy.”

“Here’s a guy who’s very savvy, I know him very well...,” Trump said. “Here’s a guy that says, ‘You know, I’m going declare a big portion of Ukraine independent’ he used the word ‘independent.’ ‘And we’re going to go out, and we’re going to go in, and we’re going to help keep peace.”

Read more:

https://www.rt.com/russia/550312-trump-putin-savvy-donbass/

READ FROM TOP.

FREE JULIAN ASSANGE NOW V√√√√√√√√√√√√√√√√√√√•••••••••••••

slippery slope...

White House spokesperson Jen Psaki told reporters on Monday the Biden administration had not yet reached a decision whether it would ban oil imports from Russia. US President Joe Biden is reportedly already planning to press Saudi Arabia to increase production and is even sending out peace feelers to Venezuela.

When the closing bell rang on Monday, US stocks had continued their downward march several weeks ago and were driven largely by the same fears: the impact of US sanctions on Russia for its special military operation in Ukraine.

The Dow Jones fell by 797.42 points on Monday to finish at 32,817.38; the Nasdaq Composite also declined, falling by 482.48 points to finish at 12,830.96; and the S&P 500 fell by 127.78 points to close at 4,201.09.

The price of petroleum continued to rise over the weekend, hitting $130 per barrel of crude before settling at $123 on Monday, as gasoline prices in the US topped $4 per gallonfor the first time in 15 years. Consequently, stocks in petroleum companies increased markedly on Monday, with oil and gas services provider Baker Hughes adding 5% to its stock value. Chevron increased by 1.4% and ExxonMobil by 2%.

“The rise in oil is destabilizing the market,” Jay Hatfield, chief executive and portfolio manager at Infrastructure Capital Advisors, told the Wall Street Journal. “The market is concerned about the war and its impact on U.S. growth and U.S. companies.”

However, bank stocks suffered greatly, with US Bancorp losing 3% of its value and Citigroup down 1.4%. Service companies also declined based on expectations of higher operating costs due to rising gas prices, with McDonald’s, Starbucks and Nike all falling.

US sanctions on the Russian economy, which have targeted its financial sector, have caused chaos in markets around the globe, and on Monday, the US and its allies began discussing a possible ban on importing Russian petroleum products - the country’s largest export. Russia provides 40% of European gas.

However, White House spokesperson Jen Psaki said on Monday that “no decision has been made at this point by the president” and offered no timeline on the decision, either.

Biden is reportedly considering a trip to Saudi Arabia to ask the world’s largest oil producer and a close US partner to increase petroleum production to offset the potential loss of Russian gas.

The New York Times also reported on Saturday that US diplomats had headed to Caracas to try and bury the hatchet with Venezuelan President Nicolas Maduro, using the lure of dropping destructive US sanctions to get him to break with Russian President Vladimir Putin, who has long supported the South American state’s stand against US hegemony in the region. The US has tried for years to oust Maduro from power by supporting a no-name opposition candidate named Juan Guaido, who declared himself the country’s interim leader three years ago.

Some fear that rising oil prices could further fuel rising inflation, which is already at its highest point in 40 years thanks to other operations cost increases caused by the COVID-19 pandemic.

Jim Paulsen, chief investment strategist for the Leuthold Group, told CNBC on Monday that "‘stagflation’ is rapidly becoming the central focus in portfolio strategies,” referring to the 1970s phenomenon caused by Middle Eastern oil exporters imposing an embargo on Western nations who supported Israel in the 1973 war.

“Preparing for slower growth and more persistent inflation is driving investor fears and actions," the analyst added.

READ MORE:

https://sputniknews.com/20220307/us-stocks-fall-by-800-points-as-anti-russia-sanctions-push-petrol-above-130-per-barrel-1093669845.html

READ FROM TOP.

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

exploding prices...

Unprecedented Western sanctions over the war in Ukraine have had a substantial impact on the Russian economy. But the attempt to isolate Moscow financially now threatens the very countries that imposed them. The global economy is already feeling the negative impact as prices for critical commodities such as oil, gas, and grain are soaring. Sanctions targeting Russia are beginning to have a major economic cost for the US and European economies, and other countries across the globe, economists say.

The biggest and most immediate impact of sanctions is being felt in the petroleum and natural gas sectors, where Russia is one of the top exporters. Energy prices are now climbing at the fastest rate in 50 years, putting pressure on businesses and household finances. Oil prices surged to their highest level in more than a decade, surpassing $130 per barrel this week. Wholesale natural gas costs are already at record levels, with prices in Europe having exceeded $3,900 per 1,000 cubic meters for the first time in history. Gasoline prices are the most expensive in US history, with the price for a gallon of regular petrol reaching $4.17 as of Tuesday, according to data by the American Automobile Association. Prices at the pumps in Europe are even higher. They have nearly doubled since anti-Russia sanctions were introduced to around €2 for a liter ($8.25/gallon). Energy costs may soon rise to unaffordable levels despite the release of strategic reserves by a number of countries, analysts warn.

A cutoff of Russia’s energy industry could mean severe consequences not just for Europe, but also for the US and the rest of the world as well. Washington announced this week a ban on Russian hydrocarbons, sending crude prices to near-record highs. Europe also said it plans to slash consumption of Russian natural gas this year as it prepares for a complete break with its single biggest energy supplier. Russia has indicated it could cut oil and gas exports if economic warfare continues to escalate. Such a move could trigger an immediate full-blown energy crisis, experts warn. The economic consequences of the spiraling energy prices are already “very serious,” according to the International Monetary Fund. Analysts say there is no way the United States and Europe could replace Russian oil and gas supplies fully within the next 12 months or absorb the consequences of a further price surge without entering recession. European economies, which are heavily reliant on Russian energy supplies, are particularly at risk of heading into a downturn, they warn.

Over the past two years, governments around the world have printed massive amounts of money to deal with the impact of the economic slowdown due to the Covid-19 pandemic. The resulting inflation, particularly in Western countries like the United States, has been surging to near-record levels. The last thing the global economy needed during the recovery was higher energy prices. The disruption of global energy markets and the subsequent surge in oil and gas prices due to the economic pressure on Russia means the price for all consumer goods will continue to soar.

Sanctions against Moscow could derail the already reduced exports of food and critical agriculture-related goods from global breadbaskets Ukraine and Russia. The two countries account for 30% of global wheat exports. Experts warn that supplies of agricultural fertilizers may also decrease around the world due to sanctions on Russia and Belarus, which together control more than a third of the world’s potash production, a key ingredient in fertilizer. Russia also controls 14% of nitrogen-based plant food production, according to the research firm CFRA. Ultimately, the impact will be higher food costs around the world, experts say.

The flight ban imposed by over 30 countries on Russian airlines and Moscow’s mirror response is having a ripple effect on global travel and the airline industry, which is already battered by the coronavirus pandemic. Manufacturers, lessors, insurers and maintenance providers to Russian carriers like Aeroflot and S7 Airlines are among those outside Russia that are hit directly by sanctions. Airlines are currently reeling from higher oil prices and longer routes needed to bypass Russian airspace. Those factors are expected to drive up ticket prices and air freight rates further. Moreover, the European Union has given leasing companies until March 28 to wind up current rental contracts in Russia. That could be a challenging task for the European companies that have leased hundreds of planes to Russian airlines and now must find a way to fly them out amid the airspace bans and Russian government’s plans to nationalize the fleet to maintain domestic capacity. The huge number of planes needing to be placed elsewhere could depress rental prices globally, analysts say. Additionally, major Western plane makers, Airbus and Boeing, will be hurt from Russia’s isolation. Not only are they losing a huge market, but Russia provides critical components such as titanium for the production of their aircraft, which will now cost more to make.

Russia is a major exporter of other commodities that are critical for the global economy. Prices for these have also been soaring, hitting their highest levels in years and hurting global economic growth. The skyrocketing price of metals has hit car manufacturers hard, as Russian supplies are at risk. Aluminum and palladium both hit record highs on Monday while, on Tuesday, nickel, which is also needed for stainless steel, passed the $100,000-a-tonne level for the first time ever. The price of coal surged to unprecedented levels, exceeding $400 per ton this week as some European countries look to ban Russian supplies. The cost of rare earths, which has surged since the second half of 2021 amid concerns of supply uncertainty and strong demand, is also on the rise.

Russia has enjoyed close economic ties with European countries, so any trade and financial sanctions are likely to hurt both sides. But the loss of the Russian market, with a population of over 144 million people, is a huge blow to European businesses. During 2021, the volume of trade between Russia and the countries of the European Union increased by 42.7% in annual terms to over €247 billion. Russia was the fifth largest partner for EU exports of goods (4.1 %) and the third largest partner for EU imports of goods (7.5 %). The EU has already imposed several rounds of severe sanctions against Moscow, targeting the country’s banking and industrial sector, freezing its foreign reserves, and causing a mass exodus of foreign businesses from the country.

Analysts say that European countries and businesses will bear the price of Western sanctions, adding that if Russia reorients itself toward friendly countries like China, “Europe would suffer the most.” The White House said recently that China’s trade with Russia isn’t enough to offset the impact of US and European sanctions on Moscow. However, trade between the two countries has been booming despite the events in Ukraine. According to Chinese customs data released on Monday, the trade turnover between the two countries increased by nearly 39% in the first two months of this year compared to the same period last year, exceeding $26 billion. Moscow and Beijing have an ambitious goal of boosting bilateral economic cooperation to $200 billion by 2024.

READ MORE:

https://www.rt.com/business/551578-russia-sanctions-west-blowback/

READ FROM TOP.

FREE JULIAN ASSANGE NOW.