Search

Recent comments

- more bombs....

1 hour 47 min ago - the middle-arse....

2 hours 2 min ago - AI trump?....

6 hours 2 min ago - meanwhile....

7 hours 29 min ago - drones....

7 hours 34 min ago - propagandum....

7 hours 57 min ago - bread and butter....

9 hours 50 min ago - activism....

11 hours 21 min ago - start writing!....

14 hours 5 min ago - beyond arrogance....

14 hours 11 min ago

Democracy Links

Member's Off-site Blogs

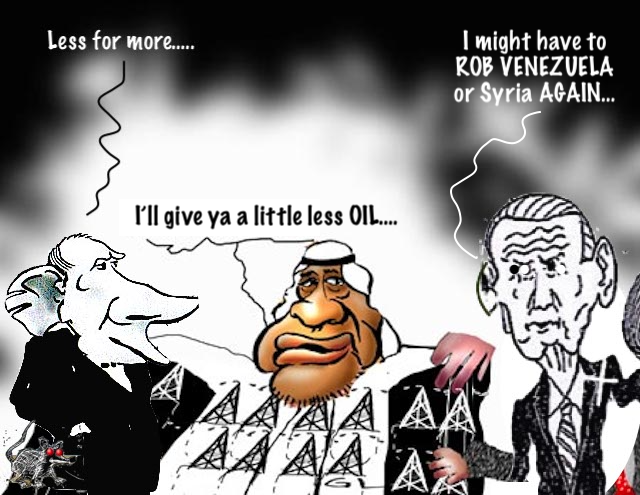

oily restrictions ..................

THE SAUDI-LED oil cartel OPEC+’s announcement earlier this month that it was cutting 2 million barrels of oil per day — a move that would drive up the price of oil just a month before midterm elections — rankled Democrats in Washington. They accused Riyadh of aligning itself with Russia, another powerful member of OPEC+, which would indeed profit off the move. “What Saudi Arabia did to help Putin continue to wage his despicable, vicious war against Ukraine will long be remembered by Americans,” said Senate Majority Leader Chuck Schumer.

But Saudi Arabia actually pushed to cut oil production twice as much as Russian President Vladimir Putin, surprising the Russians, two Saudi sources with knowledge of the negotiations told The Intercept, suggesting that Riyadh’s motives run deeper than what top Democrats want to admit. The sources requested anonymity, fearing reprisal by the Saudi government.

Public reporting has hinted at Saudi’s Arabia’s drive for a far more aggressive production cut than Russia as well as other OPEC+ members first sought. On September 27, Reuters reported that Russia favored a 1 million barrel per day cut — just half of what would later be agreed upon. Then on October 5, OPEC+ announced that it would be cutting 2 million barrels a day. On October 14, the White House’s National Security Council spokesperson John Kirby said that “more than one” OPEC+ members disagreed about the cut but were coerced by Saudi Arabia into going along with it — but he declined to specify which countries. The OPEC+ members who privately pushed back against the cut include Kuwait, Iraq, Bahrain, and even the United Arab Emirates, a close ally of Saudi Arabia’s, according to the Wall Street Journal. These countries reportedly feared that the production cuts could lead to a recession that would ultimately reduce demand for oil.

Saudi Arabia, a putative ally, pushed for even deeper cuts than what Russia, a U.S. adversary, even believed they could get away with, the sources said. “People in D.C. think MBS is siding with Putin, but I think MBS is even more Putinian than Putin,” one of the sources, a Saudi close to the royal family, said, referring to Saudi Arabia’s de facto ruler, Crown Prince Mohammed bin Salman.

READ MORE:

https://theintercept.com/2022/10/20/saudi-oil-production-cut/?

FREE JULIAN ASSANGE NOW.................

- By Gus Leonisky at 24 Oct 2022 - 10:38am

- Gus Leonisky's blog

- Login or register to post comments

dreaming of gas......

by Oleg Pavlov

The conflict in Ukraine, which entered an open military phase in February 2022, has aggravated the issue of energy supplies to Europe and, at the instigation of the Europeans, the replacement of Russian gas with “blue fuel” from other countries.

The latest climax of the discussion of these problems was the international terrorist act in October of this year against the Nord Stream 2 pipeline, which, together with Nord Stream 1, was supposed to supply Europe with cheap and reliable Russian gas for decades to come.

In this regard, the beneficiary, though not necessarily the organizer and perpetrator of this terrorist attack, is well known – it is the United States, which has long sought to subjugate the European continent and has already succeeded in many ways. But there was an “unfortunate” gap – the close connection between the EU and Russia in the field of gas. Of the 400 billion cubic meters of gas that Europe consumes annually, almost 200 were supplied by Russia until recently. However, from February 24 this year, on Washington’s advice, this gas unexpectedly became “toxic” – the gas of an “aggressor,” “molecules of dictatorship,” and in general it turned out that “buying gas from Russia contradicts European values.” Russia was declared an unreliable partner who uses gas as a political weapon, although neither the US nor the EU could confirm this statement with comprehensible arguments.

Once again, the perception was stronger than the facts. Yet Europeans themselves are aware that their prosperity and high standard of living have been secured precisely by cheap Russian energy sources, as the European Union’s High Representative for Foreign Affairs and Security, Josep Borrell, recently admitted openly and somewhat naively.

The convulsive attempts to urgently replace Russian gas led to a quadrupling of its prices, which pretty much warmed the hands of US LNG exporters. Yes, the Europeans managed to fill storage for the winter. But winterization and long-term supply of cheap energy to energy-intensive industries (steel, chemicals, etc.) are far from the same thing.

At the same time, the EU began to look for alternative suppliers of blue fuel on the basis of long-term contracts, and again it became clear that this problem cannot be solved overnight. Moreover, there is an acute shortage of both the fuel itself on the market and the routes to its delivery – pipelines and regasification points for LNG. Major suppliers such as Qatar have long since contracted their supplies on a long-term basis, Iran is under sanctions, and Norway is already supplying its maximum 20 percent of European consumption and cannot deliver more.

That leaves the United States, which is pulling three hides from its European consumers, so much so that even French President Emmanuel Macron, known for his “particular sympathies for Washington,” begged and began to accuse the United States of not being an ally. Apparently, he forgot that “friendship is one thing, business another.” After all, it is not for nothing that Washington has done everything to break relations between the EU and Russia in the energy sector, to then supply Europe with gas cheaply.

What options are left for European countries to avoid being stripped naked and robbed by the US?

The first and most reasonable way was pointed out by the Russian President Vladimir Putin, who proposed to deliver cheap Russian gas via Turkey, through the built and planned branches of the Turkish Stream. If not, then Europe will have to wait for a Ukrainian “victory” over Russia to begin developing gas resources there. But something tells the author that this last option is becoming increasingly distant and elusive.

It remains to try to select the available crumbs on the market. And this is where Africa comes in, which has fantastic reserves of “blue fuel.” Moreover, in the future (by 2040), Africa will be able to supply markets with up to 470 billion cubic meters of gas, or three-quarters of what Russia produces today. Furthermore, by 2030, the African continent will be able to replace up to 20% of the gas currently supplied by Russia to Europe. But, unfortunately, not immediately.

Who are these lucky suppliers in Africa that can at least partially replace Russian gas?

So far, there are only a few of them: Algeria, Angola, Egypt, the Republic of Congo, Nigeria, Mozambique, and Equatorial Guinea. Let us now take a closer look at this question.

Algeria has been supplying gas to Europe for a long time. It exports it via pipelines to Spain and Italy, as well as via gas tankers from two LNG plants. With a 10% share of the European continent’s imports, the country is the third-largest supplier in Africa after Russia and Norway. There is a Maghreb-Europe gas pipeline with a capacity of 12 billion cubic meters that connects the EU to the Hassi R’Mel gas field in Algeria via Morocco to Córdoba in Spain. However, in 2021, the operation of the gas pipeline was suspended due to political disagreements between Algeria and Morocco over Western Sahara. There is no real prospect of work resuming as the conflict between the two countries continues to intensify.

The second Algerian gas pipeline is the TransMed subsea pipeline to Italy, through which 22 bcm/year is pumped, with the maximum throughput reaching 32 bcm. That means, theoretically, Europe can get another 10 billion cubic meters (out of the 200 needed!) soon.

The third is the MedGaz subsea pipeline connecting Algeria to Spain, with a capacity of 8 bcm that can be increased to 10 bcm, which was already planned in February but has not happened yet.

Overall, Algeria can increase gas supplies to Europe by 12 billion cubic meters. – This is not a lot. That’s only 6% of the amount Europe needs to replace Russian gas. The other gas pipeline projects from Algeria are still “stalled” and it is not clear when they can be implemented (the author is referring to the extension of the TransMed pipeline to Sardinia and the construction of the Trans-Sahara pipeline).

Italy managed to add 2.4 billion cubic meters this year at the expense of Algeria and Egypt, as well as the Republic of Congo, but this does not solve the problem.

What about other suppliers?

Next there is Egypt. According to a report by the Organization of Arab Petroleum Exporting Countries (OAPEC), Egypt rapidly increased its exports in 2021, reaching 1.4 million metric tons of LNG in the second quarter, compared to no LNG exports in the same period of 2020. However, the disadvantage for Egypt is that it has no alternative means of supplying gas, as the country is not connected to the European pipeline network.

Egypt’s most important field is the Zohr field, which has been developed by Eni (together with Russia’s Lukoil) since 2015 and has gas reserves of 60.8 bcm. In April 2021, British Petroleum’s BP Raven field was brought on stream, but no new fields have been found since. So far, there is no reason to believe that Egypt will be able to increase its exports beyond what it has achieved so far.

A much more promising country in terms of gas supplies is Nigeria due to its large reserves and already partially created LNG production system and built gas pipelines. The resource base is offshore and onshore fields in the Niger Delta, from which gas is supplied under long-term contracts with Shell Petroleum Development Company of Nigeria (SPDC), Total Exploration and Production Nigeria (TEPNG), and Nigerian Agip Oil Company (NAOC).

Nigeria currently has 6 LNG processing plants in operation with a total capacity of 22 million tons/year of LNG and 5 million tons/year of liquefied petroleum gas (LPG) and gas condensate. Western companies such as ENI and Total Gas & Power (TGP) – a subsidiary of France’s Total – have signed contracts with Nigeria LNG to supply one and a half million tons of LNG in 2020 and 2021, equivalent in cubic meters to about 4 billion cubic meters after regasification. Nigeria LNG is a joint venture between the state-owned Nigerian National Petroleum Corporation (NNPC, 49% share), Shell Gas (25.6%), Total (15%), and Eni (10.4%). It is clear that the stated 4 billion does not even cover a small fraction of the European demand, only 1%, although the total capacity makes it possible to produce up to 30 billion cubic meters of gas per year.

With the announcement of the final investment decision for NLNG Line 7, Africa’s total liquefaction capacity is expected to reach about 44 Mtpa by 2025, making Africa the leading region for LNG after several years of decline. But it’s a long way off …

Moreover, Nigeria has 4 onshore and 2 offshore gas pipelines, whose network can still be significantly expanded. It was Europe’s desire to replace Russian gas that led to the revival of another project for pipeline gas supplies from Nigeria to Europe: the Nigeria-Morocco Gas Pipeline (NMGP). We are talking about the NMGP route on the shelf along the west coast of Africa. Its estimated length is 5,660 km. This makes it the longest subsea pipeline and the second-longest pipeline in the world (after the MNP Druzhba system, which includes 8,900 km of oil pipelines) with a throughput capacity of 30 billion m3/year. This $25 billion route from Nigeria through 11 West African countries to Morocco and Europe will be an extension of the West African Gas Pipeline, which already carries gas from Nigeria to Ghana under the Gulf of Guinea in the Atlantic Ocean. But one must consider the long time frame for implementation. The Nigerian government hopes to start the project before May 2023, with commissioning not scheduled until 2046. It is clear that for all Europe’s interest in such projects, these long-term plans cannot meet the continent’s urgent needs in the years ahead.

There is another potential gas giant on the continent – Mozambique. Its offshore gas reserves are impressive. To date, Mozambique has proven natural gas reserves of more than 5 trillion cubic meters (14th in terms of gas reserves in the world). However, the situation is complicated by the fact that all 18 fields are located at sea depths of 1500 to 2000 m and are far from the coast, so their separate development and operation do not seem economically justified.

To date, only a single LNG production project in Mozambique with a capacity of 12.88 million tons per year (about 17 billion cubic meters) is planned for the near future. However, the potential for increasing gas supplies to Europe is limited by several long-term LNG supply contracts with Japan and Taiwan, despite the increase in production. While construction work to develop the first two lines of the Mozambique LNG project was on schedule, safety concerns in late March 2021 in Cabo Delgado province in northern Mozambique forced the operator (French oil and gas company Total) to withdraw the entire staff from the project and declare force majeure. Although Patrick Pouyanné, CEO of French oil giant TotalEnergies, said during a January 2022 visit to the Mozambican capital that if the security situation improved, the company planned to restart this year a $20 billion LNG project that had been halted by Islamist militants. But again, these are long-term projects that are not capable of meeting the EU’s gigantic demand for natural gas in the near future.

Other potential gas exporters, such as Angola and Libya, are not yet developing their fields, and the volumes of other suppliers, such as the Republic of Equatorial Guinea (gas export volume is 4.7 bcm), have long been contracted. Another source could be the Republic of Congo, from which Italy will import more than 4.5 bcm of liquefied natural gas (LNG) annually.

So the facts speak for themselves. African countries are rich in gas, but in the next 3-4 years they will not be able to increase their exports to the EU to any significant extent (20 bcm at most, but more likely far less) to meet the enormous European demand. There is another important fact: Africans need gas themselves. They want to develop their industry, energy, and fertilizer production. It is far from obvious that they want to sell all their resources to Europe, which makes many promises but is in no hurry to help Africa industrialize.

In other words, Europeans should think a hundred times before using false pretexts initiated by Washington to get away from Russian gas. And African gas should be left to the Africans.

Oleg Pavlov, political commentator, exclusively for the online magazine “New Eastern Outlook”

READ MORE:

https://journal-neo.org/2022/10/25/african-gas-instead-of-russian-dreams-and-reality/

READ FROM TOP.

FREE JULIAN ASSANGE NOW∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞