Search

Recent comments

- sobering....

18 min 18 sec ago - iran's....

1 hour 49 min ago - blind interceptors....

2 hours 8 min ago - ARTIFINTEL....

3 hours 47 min ago - don't mention it....

4 hours 46 min ago - fear godot....

4 hours 50 min ago - no regeem change....

5 hours 36 min ago - blind maddow....

5 hours 46 min ago - detour 101....

6 hours 6 min ago - stupidolitics....

6 hours 18 min ago

Democracy Links

Member's Off-site Blogs

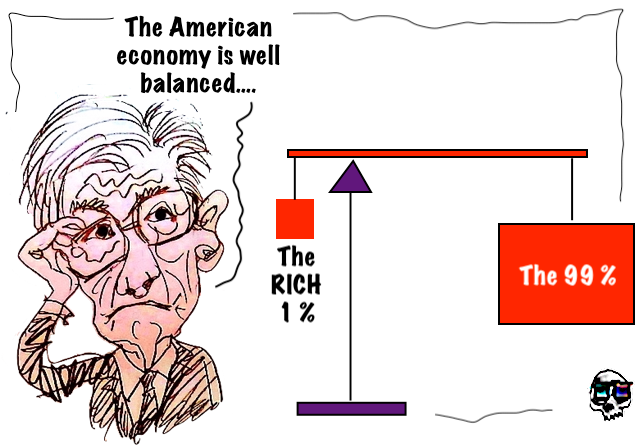

a balancing act towards disaster......

Powell told lawmakers that he did not want "to be sending any signals about the timing of any future actions" on interest rates, a stance consistent with the chair's recent efforts to focus attention more on the evolution of economic data - and the possible choices the Fed might make in response - and less on firm guidance about what might happen on what timetable.

Still, with a Nov. 5 presidential election on the horizon and just two scheduled Fed meetings before it, Powell was quizzed by Democrats about the risks to the job market of not cutting rates soon, and by Republicans about the pain to households of inflation that remains above the central bank's 2% target.

"Any move to lower rates before Nov. 5 would be a bad perception," Senator Kevin Cramer, Republican of North Dakota, said to Powell, said in remarks that went on to pledge support for central bank independence.

It was one of several moments in the hearing that, explicitly or not, were framed by the presidential vote, the political sensitivity of coming Fed decisions, and suggestions by some close to Republican candidate and former President Donald Trump that the Fed should be brought under tighter political oversight - a counter to widely accepted norms.

Powell throughout the hearing emphasized the importance of Fed independence in rate setting, as well as his own intent to stick with data-based decision-making.

His views on that front, analysts said, seemed to at least edge the door open to a rate cut as soon as September.

"His emphasis has shifted a bit towards a balance of risks within the Fed’s mandate," said Christopher Hodge, chief economist for the U.S. at Natixis in New York. "The Fed needs to get ahead of weakness in the labor market...It appears as if the foundation is being laid for a pivot in September."

Powell's semiannual appearance in the Senate will be followed by a hearing in the House set for Wednesday at 10 a.m. EDT (1400 GMT).

While Powell's opening remarks focused on a review of the economy and monetary policy, questioning from senators keyed in on housing costs and even more so on proposed changes in bank regulations that the Fed is debating internally.

US DECLINE: Massive Bank Crashes, Economic Downturn Accelerates | Prof. Richard Wolff (Part 1)

- By Gus Leonisky at 12 Jul 2024 - 8:15am

- Gus Leonisky's blog

- Login or register to post comments

public debt....

MOSCOW (Sputnik) - Global consolidated public debt exceeded $100 trillion in 2023 and is growing faster than the world economy, according to Sputnik's calculations based on data from the World Bank and the International Monetary Fund.

The calculations include data from 178 economies that published GDP reports as of mid-2023. The consolidated public debt figure includes the debt of the central government, regions and municipalities.

Global public debt increased by 5.8% in 2023 and reached $101 trillion, while global GDP grew at a slower pace of 4.2% in nominal terms and stood at $105.4 trillion. Global public debt reached 95.8% of global GDP against 94.5% year-on-year.

The largest national debt, reaching $37.5 trillion, was recorded in the United States and accounted for 35.6% of the global economy. China came in second with $14.9 trillion, or 14.1% of global GDP. The two countries’ national debt increased last year by 6% and 8%, respectively.

Japan took third place with its national debt decreasing by 3% to $10.6 trillion in 2023. At the same time, the share of Japanese debt to global GDP decreased to 10.1% from 10.8% year-on-year.

The United Kingdom, France, Italy, India, Germany, Canada, Brazil and Spain were among the countries whose public debt exceeded 1% of the global economy last year. Russia ranked 28th in terms of public debt, as it decreased by 12% in 2023 to $321.3 billion and accounted for 0.3% of the global economy.

https://sputnikglobe.com/20240712/global-public-debt-exceeds-100trln-in-2023-1119350691.html

READ FROM TOP

Brazil-RICS....

Is Brazil's Brics-building worth it?

By Robert Plummer/BBC

It's been more than a year-and-a-half since Brazil's Luiz Inácio Lula da Silva returned to the country's presidency, back from the political dead after his conviction on corruption charges was dramatically annulled.

In that time, President Lula's comeback has given renewed force to one of the world's most unlikely economic alliances - the Brics, a grouping that unites Brazil with Russia, India, China and South Africa.

In his previous time as president from 2003 to 2010, Lula was instrumental in efforts to weld the Brics into a geopolitical entity, and an emerging counterweight to the West.

Now the bloc has momentum on its side once again. It's come to be known as Brics Plus, after the original members agreed at a watershed summit in Johannesburg in August last year to admit a handful of new joiners, including Saudi Arabia and Iran.

Not bad for a grouping that was originally willed into being by sheer high-concept financial whimsy, the brainchild of economist Jim O'Neill, who saw it more as an investment opportunity than a new gang of nations.

"When the Brics were invented, it was pretty much an asset class," says Monica de Bolle, senior fellow at the Peterson Institute for International Economics in Washington.

"But it caught on in Brazil, because it directly spoke to Lula's aspirations in foreign policy."

At the Johannesburg meeting, Lula was particularly bullish about the group's long-term economic prospects.

“We have already surpassed the G7 and account for 32% of global GDP in purchasing power parity," he said.

"Projections indicate that emerging and developing markets will be those that will show the highest growth rate in the coming years," he went on.

"This shows that the dynamism of the economy is in the global south and the Brics is its driving force.”

But that is disingenuous on Lula's part, to say the least. As has been pointed out by the originator of the Bric acronym, who now rejoices in the title of Baron O'Neill of Gatley, all the economic growth in the group has actually come from Xi Jinping's China and Narendra Modi's India.

"None of the other Brics has performed anywhere near as well as those two," he said in an article written in reaction to the bloc's expansion.

"Brazil and Russia account for around the same share of global GDP as they did in 2001, and South Africa is not even the largest economy in Africa [Nigeria has surpassed it]."

As he also points out, China "dominates the Brics by being twice the size of all the others combined", in much the same way that the US dominates the G7.

So what does slow-growth Brazil gain from being dragged along in China's economic slipstream?

Rodrigo Zeidan, a Brazilian economist based at China's New York University Shanghai, tells the BBC that Brazil and China alike see the Brics as a "hedge" in terms of global alliances, rather than as a top priority.

"The Brics right now, for Brazil, cost almost nothing," he says. "So if the benefits are not high, it's fine. They are neither a big benefit nor a hindrance."

Since China is its biggest trading partner, Brazil is comfortable maintaining close relations with Beijing, even if the Brics grouping provides it with some "strange bedfellows", as Mr Zeidan puts it.

Lula has certainly maintained an ambiguous position on Russia's war in Ukraine, but that is more due to Brazil's traditional neutrality in foreign policy than to a wish to support a fellow Brics nation.

For Monica de Bolle at the Peterson Institute, herself a Brazilian economist, President Lula showed "a lot of naivety" in committing to the Brics because of his belief in furthering relations among the big so-called global south nations.

As a result, Brazil has now acquired "a China dependency" that could harm it in other foreign policy relations, she says.

"If you are in the US, you know that the US stance on China is not going to change [whoever wins the presidential election in November]," she adds.

"In either case, it's moving in the direction of greater anti-China sentiment. At some point, that's going to create additional reactions from China, which could put Brazil in a very difficult position, because it's perceived as being aligned with China."

One tangible gain for Brazil from the alliance comes in the shape of the New Development Bank (NDB), a multilateral lender founded by the Brics and described by Lula as "a milestone in effective collaboration between emerging economies".

It is currently headed by Brazilian ex-President Dilma Rousseff. She was President Lula's political protegee, and succeeded him in 2011. But her time in office came to a chaotic end when she was impeached in 2016 for breaking budgetary laws.

The NDB has not only returned her to public life, but since the bank's headquarters are in Shanghai, it makes her key to maintaining links between Brazil and China.

"Dilma is definitely huge in terms of political image. Having Dilma here in Shanghai is very important for strengthening Brazil-China relations," says Mr Zeidan.

Brazil has also benefited directly from NDB money. In June, Ms Rousseff and Brazilian Vice-President Geraldo Alckmin signed a loan deal worth more than $1.1bn (£880m) to help pay for reconstruction after widespread floods in the state of Rio Grande do Sul.

Regarding the NDB and Russia, the bank put all transactions involving the country on hold in March 2022, shortly after Russia’s invasion of Ukraine. And the NDB has complied with international sanctions against Russia.

But Russia is due to take over the rotating presidency of the bank in mid-2025 and there is some uncertainty over what will happen then.

In the meantime, Ms Rousseff is not averse to attending financial gatherings in Russia, and shaking hands with Russian President Vladimir Putin, who has praised her work at the helm of the NDB.

President Lula is a passionate advocate of the Brics as a means of reforming global governance and giving a greater voice to the developing world.

He has criticised the "paralysis" of global institutions, while praising the expansion of the Brics as strengthening the fight for more diverse perspectives.

But other observers retort that the Brics are themselves paralysed by their own internal contradictions, with Russia at war in Ukraine, while China and India have their own mutual squabbles.

Ultimately, says Ms de Bolle in Washington, the Brics are "a heterogeneous group of countries that have nothing in common, apart from the fact that they are big".

"The Brics have no clear agenda that has any real weight," agrees Mr Zeidan in Shanghai.

"Right now, China doesn't ask much of Brazil. However, anything that China asks, Brazil does.

"It's fine to be part of the Brics when the stakes are low. But what if the stakes rise?"

In other words, the effect of the Brics, on Brazil and on the world, may be minor for now. But if China decides to become more assertive, that could change rapidly - and Brazil could be faced with some uncomfortable choices.

https://www.bbc.com/news/articles/c0venrydg8yo

THE ONLY "UNCOMFORTABLE" CHOICES FOR BRAZIL WOULD BE IF THE AMERICAN EMPIRE PLACES A GUN (ECONOMIC SANCTIONS ETC) TO THAT COUNTRY... AND EVEN THEN, CHINA AND RUSSIA WOULD HELP BRAZIL DEFLECT THIS...

OF COURSE THE TONE OF THE BBC ARTICLE IS A SLIGHTLY VEILED THREAT TO BRAZIL, COMING FROM THE BBC, A MEDIA ENTITY IN BED WITH THE ANGLO/SAXON EMPIRE... BRICS IS GOOD FOR BRAZIL, THAT'S WHY THIS BBC ARTICLE IS TRYING TO PLACE DOUBT ON BRICS...

READ FROM TOP.