Search

Recent comments

- a speech never made....

8 hours 24 min ago - wardonald...

9 hours 57 min ago - MAGA fools

19 hours 16 min ago - the ugliest excuse to go to war.....

1 day 5 hours ago - morons....

1 day 7 hours ago - idiots...

1 day 7 hours ago - no reason....

1 day 8 hours ago - ask claude...

1 day 11 hours ago - dumb blonde....

1 day 19 hours ago - unhealthy USA....

1 day 19 hours ago

Democracy Links

Member's Off-site Blogs

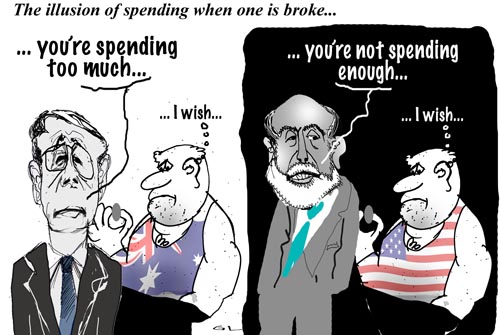

if wishes were horses, beggars would ride .....

For months, beleaguered American consumers have defied expert forecasts that they would soon succumb to the pressures of falling home prices, fewer jobs and shrinking pay-checks. Now, they appear to have given in.

On Wednesday, the Commerce Department reported that the economy continued to stagnate during the first three months of the year, with a sharp pullback in consumer spending the primary factor at play.

Pressures on households in which cash is tight appeared to weigh significantly in the calculations of the Federal Reserve as it rolled back interest rates Wednesday for the seventh time since September — this time by one-fourth of a percentage point - in a bid to prevent a further falloff in the economy.

The Fed made clear, though, that investors and borrowers should not expect another drop in interest rates anytime soon. In the statement accompanying their action, policy makers said they believed that with the short-term rate at 2 percent, they had already unleashed enough economic stimulus to “help promote moderate growth.”

With the overall economy growing at a mere 0.6 percent annual rate for the second quarter in a row, consumer spending advanced by only 1 percent, the government estimated. That was down sharply from the 2.9 percent gain for all of 2007 and the 3.1 percent gain for 2006. It was the weakest showing since 2001, the last time the economy was ensnared in a recession.

Low Spending Is Taking Toll On Economy

----------------

Class and Inflation in Australia

Just as the slump in the US economy threatens to trigger a global recession, Australian authorities have pronounced inflation 'public enemy number one' and are trying to slow growth. They tell workers to 'exercise wage restraint'.

Australian Prime Minister Kevin Rudd, Industrial Relations Minister Julia Gillard and Treasurer Wayne Swan sing the same tune: workers should accept lower wages to bring down inflation. Lower inflation, they argue, will mean lower interest rates, so everyone will benefit. To share the burden, they will be slashing the budget so hard that there would be 'screams and squeals'. Another AU$4 billion will be chopped from government spending over coming years, beyond the AU$10 billion of pruning already promised.- By Gus Leonisky at 1 May 2008 - 9:08pm

- Gus Leonisky's blog

- Login or register to post comments

wilting bananas

No More Creampuffs

The Government Is Willing to Let Wall Street Firms Fail. That's Good.

By Kenneth Rogoff

Tuesday, September 16, 2008; A21

This past weekend, the U.S. Treasury and the Federal Reserve finally made it abundantly clear that they won't bail out every significant financial firm in America. Certainly this came as a rude shock to many financiers. In allowing the nation's fourth-largest investment bank, Lehman Brothers, to file for bankruptcy, and by forcefully indicating that they are prepared to see even more bankruptcies, our financial regulators showed Wall Street that they are not such creampuffs after all.

The question now: What's next? Assuming the financial sector continues to melt down over the next couple of months, at what point, if any, should the government get back into the game? It would be a mistake to do so before a great deal more consolidation takes place. During the epic boom of the past 20 years, the financial services sector became badly bloated. At its peak, it accounted for over one-third of corporate profits in the United States, not to mention the staggering billions of dollars in bonuses that Goldman Sachs ($12.1 billion in 2007) and others paid their employees. Now, in the wake of the subprime mortgage debacle, investment banks are seeing some of their most profitable lines of business evaporate. Profits from complex mortgage products are not coming back anytime soon; nor are profits in many other areas that rely on huge borrowing.

Instead, "deleveraging" is the buzzword throughout the financial system, as firms prune their borrowing and their positions. As profits come down to more earthly levels, the U.S. financial system is going to shrink. In all likelihood, at least 15 percent of financial employees -- including at the high end -- are going to lose their jobs. In principle, this shrinkage could take place through all firms and banks trimming their operations proportionately. But that is not how a capitalist economy operates. Whether it is the auto, airline or tech industries, the strong devour the weak. That is why it was inevitable that some banks would either fail or submit to distress mergers, including even some of the largest. That is why it has been quite clear for some months that the trauma to the U.S. financial system was not over.

-------------------

Gus: It's very commendable but most of the evaporated funds are our superannuation... Unless there are some stiff penalties and sterner controls of the top people in the financial markets, greed will take over once more in a careless way...

See toon on top...