Search

Recent comments

- nukes?...

2 hours 2 min ago - rape....

2 hours 40 min ago - devastation.....

4 hours 52 min ago - bibi's dream....

6 hours 41 min ago - thus war....

10 hours 53 min ago - trump's gift....

12 hours 10 min ago - friendly fire....

12 hours 15 min ago - energy vs energy....

23 hours 1 min ago - killing kids....

1 day 1 hour ago - the die is cast....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

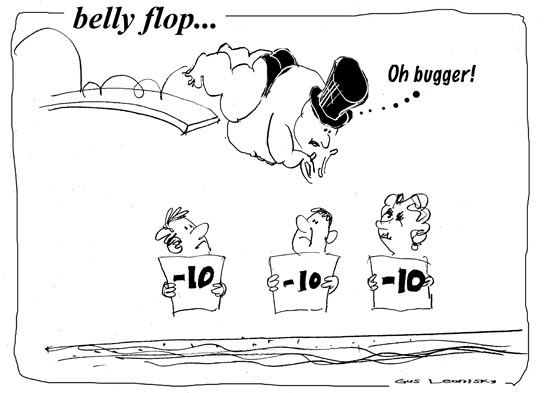

at the potomac pool .....

Until 3 pm on Thursday, it seemed as if the stock market might escape another dark day.

Then the selling hit — and hit and hit again, mimicking trading on Tuesday and Wednesday. What had been a moderately down day ended in a rout, with the Dow Jones industrial average closing down 679 points, or 7.3percent, leaving it below 9,000 for the first time in five years.

In the busiest day in New York Stock Exchange history, panicky investors dumped stocks en masse. Almost no corner of the market was spared, with 1,754 stocks falling and just 87 rising on the Big Board.

Despite unprecedented steps by policy makers around the world to defuse the financial crisis, fear is spreading that a deep global recession is at hand. The credit markets, the heart of the financial system, remained in near paralysis.

“There is a downward spiral of fear,” said Richard Sparks, senior equities analyst at Schaeffer’s Investment Research.

The plunge came in a stomach-churning 90 minutes. The Dow was down just 140points at 2:30 p.m., and 200 points at 3. But then, wave after wave of selling began to roll through the market. By 3:20, the index was down 380 points. Ten minutes later, it was down 390 points. By 3:45, it was down 660. After staging a brief rally, it fell again.

In the last six trading days — starting last Thursday — the Dow has plummeted 2,251.8 points, or 20.8 percent, a decline big enough, on its own, to mark the start of a bear market. It also is similar to the drop in the Dow on Black Monday, Oct. 19, 1987, when it fell 22.6 percent.

- By Gus Leonisky at 11 Oct 2008 - 6:23am

- Gus Leonisky's blog

- Login or register to post comments

kilometers, kilos or (k) thousands?

Retirement Wreck

Are 401(k)s Still Viable for Saving?

By Nancy Trejos

Washington Post Staff Writer

Sunday, October 12, 2008; F01

For many Americans, 401(k) plans were supposed to be their own little golden parachutes into retirement.

Now, it seems, those parachutes may not open in time.

The global financial crisis that revealed the flaws of Wall Street has also exposed the vulnerability of America's retirement system. Employers have increasingly abandoned traditional pensions, forcing workers to rely on 401(k)s and similar plans that have a lot more exposure to the stock market. The assumption was that even if the market suffered short-term losses, over time it would rise, allowing workers to recoup their savings. But the steepness of this year's market collapse and the still-uncertain depth of the economic downturn has prompted lawmakers, academics and economists to question the wisdom of letting workers hitch their retirement fortunes to the precariousness of the stock market.

So far this year, the Dow Jones industrial average is down 36 percent, eroding the savings of millions of Americans and forcing those who had planned to retire in the next few years to reconsider their plans.

"Right now, we're really seeing the risks come home, and people are recognizing the extent to which their retirement savings are on the line when the stock market goes down drastically," said Jacob Hacker, a political science professor at the University of California at Berkeley who chronicled the advent of 401(k) plans in "The Great Risk Shift."

Until three decades ago, Social Security and pensions, formally known as defined-benefit plans, were the main sources of retirement income. Now, Social Security is in danger of eventually running out of money. And defined-benefit plans, in which employers made the investment decisions and promised to pay employees a set amount each month for the rest of their lives, are quickly disappearing.

-------------------

kilometers, kilos or thousands? warp speed and flap mass ... see toon at top.

13 October 2008, 13:00

13 October 2008, 13:00

Reprising the 1930s degringolade

Alan Moran

"You don't know what you're doing" is the soccer crowd's refrain to a failing team manager's player selections. Such an accusation applies to almost all the world's central bankers, whose carefully cultivated pretensions of deific prescience are now deflated.

Aside from attempting to address the economic mess they have created, central bankers are setting out their apologias. The authorised version is given by Charles I. Plosser, President and Chief Executive Officer, Federal Reserve Bank of Philadelphia.

Plosser tells us that monetary policy can't do everything. He says it cannot protect against buffeting caused by non-monetary disturbances, such as a sharp rise in the price of oil or a sharp drop in the housing market.

In fact, soaring oil price increases over the past couple of years were absorbed without causing economic dislocation. As for house price increases, these were caused partly by governments forcing up the price of housing land (and in the US requiring relaxed lending standards) and partly by the reckless expansion in the money supply fomented by the Fed and, indeed, by our Reserve Bank.

Plosser adds. "Encouraging the belief that any system of financial regulation and supervision can prevent all types of financial instability would be a mistake. Instead, our goal should be to lower the probability of a financial crisis and the costs imposed from any troubled financial institution." Having specified such limited goals, neither Plosser nor other central bankers and Treasury chiefs have acknowledged their abject failure to meet them.

For the central bankers, their bail-out proposals are policy-on-the-run with no sense of fitting the colossal rescue sums they want into what is needed. The US $700 billion is inadequate to liquidate the "toxic debt" variously estimated at $3-6 trillion. It will be used to reward the very people who have acted recklessly in their borrowing and lending and it is being accompanied by a re-run of the very low interest rates that were the original cause of the debacle.

---------------

see toon at top...

splashhh...

Wall Street has suffered its biggest plunge since the crash of 1987.

Stocks have been hammered by fears that the US is in a recession, after the head of the San Francisco Federal Reserve said she believed that a recession had begun.

The Dow Jones Industrial Average slid 733.08 points (7.87 per cent) to 8,577.91 and the broad Standard & Poor's index plunged 90.18 points (9.04 per cent) to 907.83 just after the closing bell.

The tech-heavy Nasdaq lost 150.68 points (8.47 per cent) to 1,628.33 in another brutal session for stocks, despite massive rescue efforts for the ailing global banking sector.

-------------------

Someone somewhere must be raking in the loot... despite the leaky bucket...