Search

Recent comments

- escalationing....

10 hours 3 min ago - not happy, john....

14 hours 22 min ago - corrupt....

19 hours 43 min ago - laughing....

21 hours 37 min ago - meanwhile....

23 hours 6 min ago - a long day....

1 day 1 hour ago - pressure....

1 day 1 hour ago - peer pressure....

1 day 17 hours ago - strike back....

1 day 17 hours ago - israel paid....

1 day 18 hours ago

Democracy Links

Member's Off-site Blogs

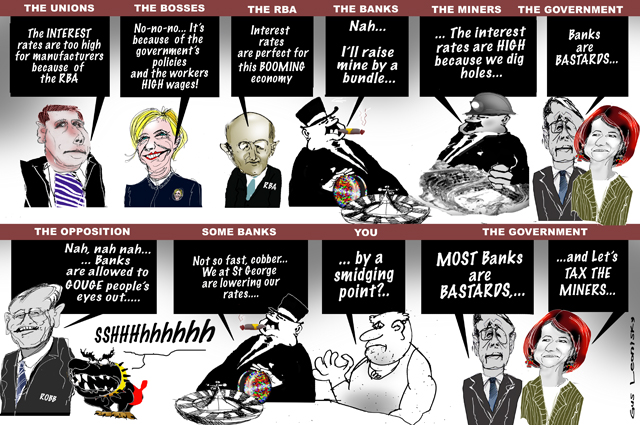

the main cogs of capitalism...

- By Gus Leonisky at 17 Apr 2012 - 6:22pm

- Gus Leonisky's blog

- Login or register to post comments

the greedy banks...

You have to admire our banks and their lobbyists. For they have gallantly stood firm for almost four years, stoically refusing to budge even as the forces of logic threaten to engulf them.

Every few months, with regular monotony, they trot out the very same argument that ''rising funding costs have forced us to raise interest rates''.

What began as pure farce quickly degenerated into sad comedy. But now it has become downright insulting. For crying out loud, fellas, at least be a little more creative. Come up with something new, please. It's time to put another piece of scratched vinyl on the turntable.

Read more: http://www.smh.com.au/business/banks-at-risk-of-believing-own-myths-20120416-1x3ul.html#ixzz1sII1depg

the narky opposition...

OPPOSITION Leader Tony Abbott has refused to endorse comments from his finance spokesman, Andrew Robb, who said ANZ Bank may have needed to raise mortgage rates to keep its profits healthy.

As the political row over mortgage costs reignited yesterday, Mr Robb said ANZ was ''not stupid,'' and were unlikely to have raised rates by 0.06 percentage points last week unless profit margins were under threat.

With other banks yet to say if they will follow ANZ's move, Mr Robb sought to pin the blame on the level of federal government debt - which he said was keeping official interest rates higher - rather than the bank.

Read more: http://www.smh.com.au/opinion/political-news/abbott-robb-disagree-on-anz-20120416-1x3t7.html#ixzz1sIIVkoLC

domesticating the RBA...

Today’s Reserve Bank board minutes show there’s an increasing gap between Canberra’s rhetoric and the RBA’s careful phrasing: the government’s budget surplus fixation won’t give the RBA "room to move should it choose to do so" but potentially force it to start stimulating the economy; banks aren’t “defying” the RBA and the Treasurer by raising rates but reflecting greater competition for funds.

If you’re one of the interest rate fixated, don’t worry about the latter business – the RBA targets the end rates people pay in setting monetary policy so the finetuning of the ANZ et al doesn’t really matter – but there are reasons to be very careful what you wish for when it comes to cutting rates.

Read more: http://www.smh.com.au/business/be-careful-what-you-wish-for-on-rate-cuts-20120417-1x4wo.html#ixzz1sIW601tl

the weather...

Weather has been a factor during the past three months with cyclones and floods interrupting production in crucial parts of Western Australia and Queensland.

Rio said its share of iron ore production from mines it owns outright and in joint ventures dropped to 46 million tonnes in the quarter versus 51.2 million tonnes in the previous quarter. Iron ore production on a 100 per cent basis in the March quarter was 59 million tonnes versus 65 million in the previous quarter.

Rio forecast iron ore output in 2012 would reach 250 million tonnes in 2012 on a 100 per cent basis.

Read more: http://www.smh.com.au/business/rio-blames-output-drop-on-weather-20120417-1x50w.html#ixzz1sIWlMw3Q

unions VS the RBA...

The head of the Australian Workers Union chief Paul Howes has called on the federal government to urgently review the charter of the Reserve Bank of Australia, suggesting its current policy setting is inappropriate while the manufacturing industry struggles under the weight of a high Australian dollar.

It’s useful here to note here what the so-called Charter of the RBA says: in part, that its powers should be “exercised in such a manner as, in the opinion of the Reserve Bank board, will best contribute to: the stability of the currency of Australia; the maintenance of full employment in Australia; and the economic prosperity and welfare of the people of Australia”.

http://www.businessspectator.com.au/bs.nsf/Article/Paul-Howes-RBA-interest-rates-inflation-monetary-p-pd20120411-T992D?OpenDocument

the opposition lack of understanding...

With economics it is harder, because things that sound reasonable in reality are actually not. Take Tony Abbott on Monday saying the following about interest rates:

I think that if the Government wasn't borrowing $100 million every single day it would be a lot easier for the banks to keep interest rates down. Everyone needs to understand that when the Government is out there borrowing $100 million every single day, there is going to be upwards pressure on interest rates. So, the best thing the Government can do to help the Australian people is get its own spending under control.

Now the view that Government debt is having a significant impact on interest rates might pass muster if we lived in a closed economy where the Government and banks had to fight for the same domestic source of finance. But the reality is banks now raise funds through a number of ways (as I discussed in February). The sense that the Government's borrowing is increasing the costs for banks to raise money on the international bond market is laughable. The line however contains enough "oh he's talking about finance stuff, he must know what's going on" to allow him to get away with it. And if he says it enough, well then people start to think it is truth, and it gets nary a challenge.

Except here's a shock: banking costs in the past few months have actually gone down. Yep down.

As I also noted back in February, 50 per cent of banks' funding costs are due to deposit rates - i.e. the price banks have to pay you to get your money. So how has the spread between what banks offer you for term deposits and the cash rate been going in the past 12 months?

http://www.abc.net.au/unleashed/3957366.html?WT.svl=theDrum

-------------------------

Yes we know that what Tony Abbott says is a lot of codswallop but to the average punter, because he says it with a straight face, he must know what he's talking about — which he isn't...

the government....

Federal Treasurer Wayne Swan has used a slight International Monetary Fund downgrade of Australia's growth projections to push the Government's case for a return to surplus.

The IMF's World Economic Outlook report for April says Australia is projected to experience 3 per cent growth this year, down from the 3.3 per cent prediction last September.

Unemployment is expected to remain steady at 5.2 per cent, but the IMF says Australia is among a number of countries that remain vulnerable to global financial markets.

Mr Swan says the projections are in line with those released by Treasury in its mid-year budget update late last year.

He says given Australia's strong investment prospects, a surplus is "more important than ever" and will build a buffer against international fluctuations.

"The IMF forecasts show that the Australian economy will outperform every other major advanced economy this year and next," he told AM.

http://www.abc.net.au/news/2012-04-18/swan-on-imf-report/3957732

the investors...

In a stinging rebuke, Citigroup shareholders rebuffed on Tuesday the bank’s $15 million pay package for its chief executive, Vikram S. Pandit, marking the first time that stock owners have united in opposition to outsized compensation at a financial giant.

The shareholder vote, which comes amid a rising national debate over income inequality, suggests that anger over pay for chief executives has spread from Occupy Wall Street to wealthy institutional investors like pension fund and mutual fund managers. About 55 percent of the shareholders voting were against the plan, which laid out compensation for the bank’s five top executives, including Mr. Pandit.

http://dealbook.nytimes.com/2012/04/17/citigroup-shareholders-reject-executive-pay-plan/?hp

super investor chief...

The head of one of Australia's most powerful superannuation funds is calling on the Federal Government to rewrite the Reserve Bank's charter, warning that the central bank's focus on managing inflation is damaging the economy.

The chairman of Industry Super Network, Garry Weaven, says that with inflation now under control, the RBA should be using interest rate cuts to boost employment and to drive down the value of the Australian dollar.

http://www.abc.net.au/news/2012-04-18/super-chief-joins-call-for-rba-review/3957616

up and down...

The Australian share market reached a five-month high today led by solid gains in the mining sector as investors digested a range of good news.

A successful auction of Spanish government bonds and strong profits results from several companies in the United States helped boost Wall Street overnight.

And the International Monetary Fund's decision to raise its global growth forecast added to positive sentiment among investors overseas.

The IMF also downgraded its forecast for Australian growth, but the strong overseas leads appear to have been sufficient to boost the local market.

http://www.abc.net.au/news/2012-04-18/australian-share-market-rallies/3958586

By now you would know that yesterday mining shares took a plunge.... It's all part of the up and down deliberate yoyo so some can win and others can loose, while the gate keepers take their commissions...

no surprise...

The Reserve Bank has handed borrowers and the struggling non-mining sector some relief, slicing interest rates by 50 basis points in a surprise move.

At its May meeting the board of the central bank cut the cash rate to 3.75 per cent, its lowest level since December 2009.

Federal Treasurer Wayne Swan welcomed the decision as "the interest rate cut that households and small businesses have been hanging out for".

http://www.abc.net.au/news/2012-05-01/rba-cuts-interest-rates-by-50-basis-points/3982998?WT.svl=news0

Well I would have been surprised had the RBA done something else... The RBA has been hammered by the unions, by the government, by the former RBS chief and may other luminaries... I am surprise the RBA did not go the full hog of 100 points down the fiddle...

Meanwhile:

The former prime minister, John Howard, has told a mining conference in Perth the world is too mesmerised by China.

Mr Howard has spoken at the Chamber of Minerals and Energy's annual general meeting about the problems of relying on China to power economic growth.

He says the political climate in China, and its ageing population, will create challenges for the country.

http://www.abc.net.au/news/2012-05-01/howard-says-world-too-mesmerised-by-china/3983372Oh, it's a privilege to know that the old fellow is still trying to appropriate the obvious... Life is a long line of ups and downs along the obvious track... No, we are not too mesmerised by China... when China down-turn comes along, we'll go and play marbles with someone else... That's life...

See toon at top...

no surprise either...

Bank of Queensland is the first bank to respond to the RBA's bigger than expected rate cut, but the wait for the big banks to move may take days, analysts say.

The RBA slashed the official rate to 3.75 per cent from 4.25 per cent, pointing to the slowdown in the domestic economy and ongoing worries about the health of the global economy, but so far not one of the big four banks has moved.

Read more: http://www.smh.com.au/business/big-banks-in-no-hurry-to-follow-rba-20120501-1xwrq.html#ixzz1tbGyC86nthe hole diggers...

Like a man who buys a cheap house next to a pub and then complains that the noise late at night is depressing his house price, the Minerals Council has come out and complained that Australia is now an expensive place to do mining.

The Minerals Council of Australia released a report by Port Jackson Partners that pointed out that cost pressures are increasing in the mining industry. It showed that since 2007, the cost of producing new capacity in thermal coal and iron ore has almost doubled. It claimed we have also lost our dominance in mining competitiveness to other nations around the world.

Then in predictable fashion, it called on the Government to fix all their problems. Large global mining companies thinking governments have all the answers - whatever happened to market forces?

They called on government to address infrastructure bottle necks, falling productivity, skills shortages, and even went as far as calling for relief from the high exchange rate. They asked for all of this without ever mentioning that all these economic problems are caused by the mining boom itself.

This is because the mining industry is intent on building too many new mining projects at the same time, as well as exporting as much dirt as they possibly can...

http://www.abc.net.au/unleashed/4050678.html?WT.svl=theDrum

see toon at top...

from a begrudging john hewson...

The begrudging reduction by the RBA in its official cash rate by just 25 basis points yesterday is still far too little, far too late, even if fully passed on by the banks.

The RBA has consistently misread the actual and prospective state of our economy. As a result it cranked interest rates up too far, too fast, and, despite recent reductions, has kept them too high for too long.

It is now playing catch-up, but far too slowly.

It is waiting to see the "whites of the eyes" of a domestic, non-resource recession before it fully recognises the errors of its ways. The way it does things, given the significant lags in any effect of any of its interest rate decisions, it will be too late.

And don't expect them to ever admit "we got it wrong"!

http://www.abc.net.au/unleashed/4056038.html?WT.svl=theDrum