Search

Recent comments

- be brave, albo....

1 hour 30 min ago - epstein class....

2 hours 35 min ago - in writing....

2 hours 46 min ago - hoped....

4 hours 46 min ago - murdering kids....

5 hours 47 min ago - saving....

6 hours 15 min ago - a speech never made....

19 hours 47 min ago - wardonald...

21 hours 19 min ago - MAGA fools

1 day 6 hours ago - the ugliest excuse to go to war.....

1 day 16 hours ago

Democracy Links

Member's Off-site Blogs

real political leadership .....

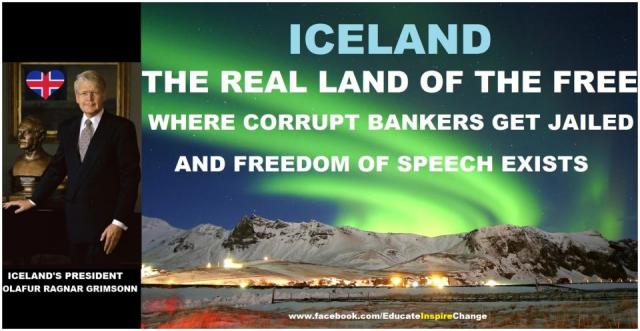

Unlike the rest of the world’s nations, Iceland has taken strong steps to reduce some of the in-your-face corruption that led to the global financial crisis. Four former heads of Iceland’s Kaupthing Bank have been sentenced to prison for between three to five years – the heaviest sentence for financial fraud in Iceland’s history.

Around the world hundreds of millions of people endured various degrees of hardship from the impacts of the global financial meltdown, while banks instead of ordinary citizens, mortgagees and investors were bailed out by their governments. People lost their homes, life savings, superannuation and some took their lives.

Banks had set up lending schemes deliriously bent by a profit motive only, with these schemes not taking into consideration the capacity of the borrower to repay. This is all old news but bona fide checks and balances are still afar.

The jailed former Kaupthing Bank head honchos include the former chief executive officer, the chairman of Kaupthing board, one of the bank’s majority owners and the chief executive of the Luxembourg branch. The bank collapsed in 2008 in the midst of the global financial crisis with a wave of debts it could not handle during the global meltdown. Kaupthing’s collapse during the crisis brought the formerly prosperous island nation to its knees, painfully grinding it to an economic halt.

But the bankers have been jailed only for that which they could be legally caught out on, not that they had cheated millions of people by their immoral and what should be illegal practices – they were jailed around the issue of a 5 per cent stake they had sold, to a Qatari sheikh, during the financial crisis in 2008, to publicly boost confidence in the bank – this was weeks away from the bank’s total financial collapse.

The 5 per cent stake hold publicly influenced, and manipulated, the bank’s share price. Another larger case against the bank is ongoing, in which it is directly accused of market manipulation. This case will come to a close early next year.

The Qatari sheikh felt he had been deceived and when Kaupthing bank went into administration, the sheikh made a deal with the administrators which led to disclosures that the prosecutors could tap into. Kaupthing bank used shell companies in the British Virgin Islands to transfer monies to allow the sheikh to pay for the shares. The monies from the sheikh were ultimately deposited into shell companies of Kaupthing.

Recently, New York Judge Jed Rakoff during a large scale fraud trial involving the Bank of America, in which they were only fined, criticised systemic failures and the cultures of favour-dispensation that allowed high level executives and chief executive officers to escape prosecution from financial crises they manifest, crises that affect millions and at times billions of lives.

Judge Rakoff said that despite the prosecution of companies for bringing about the 2007-08 global financial crisis, that the accountability factor did not reach the architects of the disaster, the high-level executives. Companies as an imagined entity weathered the hits while the people who make up these companies and who behind the scenes reap the spoils of essentially highway robbery are effectively immune from accountability, transparency and justice – there is never any prosecution of those at the top.

It has long been known that there are shadow states where transnational decisions are made about excessive wealth creation and the depositing of revenue in trusts and havens so as for great wealth to be generated away from any taxation liability. It is true that more funds are hidden in the tax havens littered around the world distant from assessable taxation scrutiny than there are funds publicly known. Therefore there is a hidden black economy, a cash economy that clearly contributes to domestic and international financial meltdowns. Money that if it had been used otherwise could reduce extreme poverty, but instead is hidden for personal use – excesses.

Journalists Gerald Ryle and Marina Walker-Guevarra have revealed some of the extent of what we all know exists, a world of offshore tax havens. Some say these havens are not illegal but yes, indeed they are illegal. The depositing of funds generated by an individual or organisation into these havens who then fail to declare these funds to relevant authorities is indeed illegal. The creating of shell companies to draw on these funds for personal use is also illegal, the paying off of others to act as directors of these shell companies so as to hide these funds is an act of fraud. But these are common practices – still despite the huge legal teams that defend those caught out, and despite some previous judicial rulings in their favour, they are and remain illegal practices.

Mr Ryle writes that offshore financial secrecy has aggressively spread around the world, “allowing the wealthy to avoid taxes, and fuelling corruption and economic woes.” Mr Ryle is a director of the International Consortium of Investigative Journalists (ICIJ) and he and his team have been investigating a data trove of 2.5 million leaked files that came into his possession on cross border tax havens. In April the ICIJ launched the second part of a multi-year project aimed at finding the owners of anonymous companies.

Mr Ryle and Ms Guevarra write, “Our investigation opened the secrets of more than 120,000 offshore companies and trusts, and nearly 130,000 individuals and agents, exposing hidden dealings of politicians, con artists, and the mega-rich in more than 170 countries.”

Within hours their Secrecy For Sale: Inside The Global Offshore Money Maze went viral and became known as ‘Offshore Leaks’. “The files identified the individuals behind covert companies and private trusts based in the British Virgin Islands, the Cook Islands, Singapore, and other offshore tax havens. They include American doctors, dentists, and middle-class Greek villagers as well as Russian corporate executives, Eastern European and Indonesian billionaires, Wall Street fraudsters, international arms dealers, and families and associates of long-time dictators.”

Mr Ryle and Ms Gueverra found that “many of the world’s top banks – including UBS, Clariden and Deutsche Bank – have aggressively worked to provide their customers with secrecy-cloaked companies in the British Virgin Islands and other offshore hideaways.”

“A well-paid industry of accountants, middlemen, and other operatives has helped offshore patrons shroud their identities and business interests, providing shelter in many cases to money laundering or other misconduct.”

There is a sense that there is some urgency to address the proliferation of tax havens but nothing will be done, unless there is sustained coverage which needs to include the mainstream media and hence alter the political landscape. Days after the ICIJ articles ran, the European Commissioner for Taxation, Algirdas Semeta said “recent development, fuelled by the outcome of the Offshore Leaks, confirms the urgency for more and better action against tax evasion.” But these are just words, the shadow states are powerful and attrition is how they game outcomes.

But Mr Ryle has hope which I do not share, “Shortly after Semeta’s words, Luxembourg officials announced that they would end bank secrecy in their country for European citizens who have money saved in Luxembourg banks. Even more surprising was the news that Britain’s overseas territories have now agreed to start sharing information about beneficial owners of offshore accounts with the UK, France, Italy and Spain.”

But tax evasion is as British Prime Minister David Cameron described at a G8 meeting “the scourge.”

He said, “We need to know who really owns a company, who profits from it, whether taxes are paid.” Any bona fide turnover of such information will discover that this list would include former British prime ministers and people from the highest officers in the nations, past and present.

The ICIJ work is paramount, because like WikiLeaks’ release of the Collateral Murder Video it makes the confrontation with the truth unavoidable, but the clash with the truth does bring the eyes and ears of the shadow states, and even more shadowy figures within the darkness, to bear upon those who are prepared to prevail in truth finding, as we search for a better global society.

The story that the future will unfold is that two-thirds of the world’s money is tied up in these not only effectively illegal but outright immoral tax havens. Money that is not taxed or at least treated with the most obscene tax minimisation while hundreds of millions of people are told to live with ‘austerity’.

Iceland Jails Bank Bosses But Tax Havens Hide Two Thirds Of The World's Taxable Revenue

- By John Richardson at 17 Dec 2013 - 2:35pm

- John Richardson's blog

- Login or register to post comments

more crap from the abbott...

The attorney general has appointed a director from the right-wing thinktank the Institute of Public Affairs as Australia’s human rights commissioner.

George Brandis said Tim Wilson, a member of the Liberal party until this month, had been appointed to “restore balance” to the Human Rights Commission.

Wilson, a self-declared classic libertarian, directs climate change policy at the IPA as well as the Intellectual Property and Free Trade Unit.

Wilson said he had stepped down from his position at the IPA as well as resigned from the Liberal party to take up the appointment.

The IPA called for the Human Rights Commission to be abolished earlier this year with Simon Breheny, director of its Legal Rights Project, saying it did not protect human rights.

“The Australian Human Rights Commission does not defend fundamental rights such as the right to free speech and property. Instead, it selectively defends a human rights agenda determined entirely by the left," he said at the time.

"The commission is 100% taxpayer-funded yet it actively lobbies government for laws which undermine human rights, rather than defending and protecting them. It should be abolished.”

http://www.theguardian.com/world/2013/dec/17/thinktank-director-tim-wilson-appointed-human-rights-commissioner

-------------------------------------

Yes, George Brandis, the new attorney general, has long mistaken Human rights for the freedom to screw people over, verbally and physically.... HORRID THOUGHTS THAT THE IPA now is in charge of a very sensitive area of human relationships...