Search

Recent comments

- cow bells....

13 hours 18 min ago - exiled....

18 hours 21 min ago - whitewashing a turd....

19 hours 20 min ago - send him back....

20 hours 50 min ago - the original...

22 hours 38 min ago - NZ leaks....

1 day 8 hours ago - help?....

1 day 9 hours ago - maps....

1 day 9 hours ago - bastards...

1 day 16 hours ago - narcissist.....

1 day 17 hours ago

Democracy Links

Member's Off-site Blogs

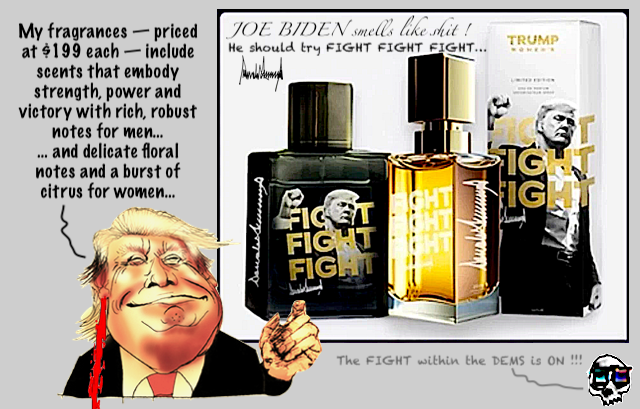

annoying smell to the democrats....

The “Trump Fragrances” website features a cologne and perfume labeled “Fight, Fight, Fight,” the phrase Trump appeared to say after an assassination attempt on him during a campaign rally in July.

The fragrances—priced at $199 each—include scents that “[embody] strength, power and victory” with “rich, robust notes” for men and “delicate floral notes and a burst of citrus” for women.

Trump, who previously promoted a line of “Trump Watches” ranging up to $100,000, announced several new additions, ranging from $499 to a collector set valued at more than $5,300.

Among the new watches are a silver “Trump Racer” valued at $2,999 and a $899 “First Lady” edition featuring Trump’s name and signature.

Trump promoted other merchandise throughout his campaign and after his election win, as the president-elect faces hundreds of millions of dollars in unpaid legal fees. He announced a series of “Trump Watches” valued up to $100,000 in September, following the debut of $100 silver coins—sold at a higher price than the market value of silver—and 1,000 pairs of limited edition sneakers, $60 Trump-branded Bibles and NFT cards. He hawked an earlier line of cologne and perfume labeled “Victory” shortly after Election Day valued at $119. Last year, Trump offered a “Mugshot Edition” of digital trading cards featuring a bonus offer for a piece of his suit from his Fulton County, Georgia, mug shot and dinner with Trump at Mar-a-Lago.

Most of the revenue Trump has received from his merchandise came from his NFTS, which reportedly earned him about $7.2 million in licensing fees. The Trump-branded bibles generated about $300,000 in sales, while his $399 sneakers sold out, adding another $399,000. His signed and unsigned “American Eagle” electric guitars sold out at $11,500 and $1,500 each, respectively, generating a combined $4.6 million in sales. It’s not immediately clear how much Trump earned from his earlier release of watches or silver coins.

FORBES VALUATIONTrump is the 546th-richest person in the world, with a fortune valued at $6.1 billion, according to our latest estimates.

SEE ALSO: https://www.youtube.com/watch?v=_kx4uy8bSgw

Trump Charms Jill Biden and Prince William During Paris Visit, with Amala Ekpunobi and Link Lauren

SEE ALSO: https://www.youtube.com/watch?v=3wyImlwMFvs

THE DEMS FIGHT DIRTY AMONGST THEMSELVES

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

PLEASE DO NOT BLAME RUSSIA IF WW3 STARTS. BLAME YOURSELF.

- By Gus Leonisky at 11 Dec 2024 - 5:18pm

- Gus Leonisky's blog

- Login or register to post comments

selling delusions....

Trump’s economic delusions By Michael KeatingTrump’s economic strategy is based on a series of delusions that will result in higher inflation, a bigger trade deficit and a loss in the value of the American dollar. How can that Make America Great Again?

Trump’s tariff delusion

President Trump is on record as saying, multiple times, that “tariffs” are his favourite word. Accordingly, Trump has promised to impose 25% tariffs on Canada and Mexico, and an extra 10% on China on his first day in office. Other countries can soon expect tariff increases too.

As Trump sees it, any country that has a trade surplus with the US must be unfairly taking advantage of America. Luckily Australia can plead ‘not guilty’ as we have a trade deficit with America, but most other countries are guilty.

Indeed, in total the US has a current account deficit on its balance of payments with the rest of the world, equivalent to as much as 3.7 per cent of its GDP. Furthermore, this deficit is not a one-off – America’s trade deficit has been high for a long time, including through the former Trump presidency.

But Trump’s first fallacy is his delusion that an increase in tariffs will reduce America’s trade deficit. To Trump it may seem obvious if the prices of foreign products in the US are increased relative to the prices of similar American products then the US demand for those foreign products will fall.

The reality however is that the US current account deficit is always identical to the difference between total domestic demand in the US and the amount that it produces itself. If there were spare productive capacity in the US then it is possible that a tariff increase would lead to increased supply of the competing American-made goods and thus reduce the trade deficit.

But a second reality is that there is no significant spare capacity in the US to substitute for foreign-made goods and services. The US is pretty much at full-employment, and there is thus little or no spare capacity.

Trump’s second fallacy is that the foreigners will absorb the cost of the extra US tariffs and not pass it on in their American price. However, again the reality is that the foreigners will pass on the cost of the tariffs to their American consumers. The foreigners have no need to cut their American prices, as they can redirect their sales to other countries.

Similarly, American consumers could switch to other foreign suppliers instead of China, but only so long as the tariffs on these other countries’ goods do not increase as well. Also, these other foreign sources are likely to be at least a bit more expensive in response to the increased US demand for their products.

At the margin, the increase in the prices of imports resulting from the tariffs may also lead to some redirection of labour in the US to those industries competing with imports. This switch will be limited, however, and it will then put pressure on the prices of the goods and services produced by the US industries that have lost labour.

In particular, the North American supply chain is highly integrated. Half of American fruit and vegetables come from its two neighbours, Canada and Mexico, and more than half the pickup trucks sold in the US are made in these two countries. Pushing up these prices through tariff increases, will severely damage the typical American’s cost of living.

Furthermore, it is not only economic theory that says that tariffs will not fix a trade imbalance. Indeed, we know from experience that tariff increases on China have not worked in the past, as China’s trade surplus with America today remains about the same as it was before Trump increased tariffs back in 2018.

In short, Trump’s tariffs will not significantly reduce America’s current account deficit but will lead to higher inflation.

How to reduce the current account deficit

The only way the US could realistically reduce its current account deficit is to increase its domestic savings – either public and/or private savings. That will automatically reduce total domestic demand and thus close the present gap between that demand and US production capacity.

The obvious place to start would be to reduce the budget deficit. According to the OECD the government sector in the US is running a deficit this year equivalent to as much as 7.6 per cent of GDP. Some of this would be State and local government deficits, but the vast majority – around 6 per cent – is the US Federal Government. Furthermore, the Congressional Budget Office, an independent scorer, is predicting that on present policies the US Government will continue to run a budget deficit of about 6 per cent over the next decade.

Trump is claiming that, with the support of Elon Musk, he will be able to reduce expenditure by vast amounts and that total revenue will be augmented by the capture of the extra tariff revenue. On the other hand, Trump is also promising large income tax cuts that will put further pressure on the budget deficit and reduce national savings.

The eventual budget outcome is uncertain at this stage, but cuts to pensions, health insurance, and defence have been ruled off-limits. The interest payments on existing government debt cannot be cut either, so that only leaves about 13 per cent of total government outlays that could be subject to cuts. Thus, there is no way that Trump and Musk can anywhere near achieve the budget savings that they are talking about.

It therefore seems most unlikely that Trump will significantly reduce the US budget deficit, even if Trump reneges on his promised tax cuts. Thus, the pressure will continue on the US balance of payments and on inflation as well because of the risk of excess demand in the US and because every US citizen will be paying more for products produced overseas.

The inflation outlook and the US$

Almost half the trade in the world is paid for with US dollars. Accordingly, countries tend to hold their currency reserves in the US, often in the form of US government bonds so their foreign exchange reserves can earn interest. For example, the Chinese government is the single largest holder of US government bonds, and it is effectively helping to prop up the value of the American dollar.

However, the dollar can only expect to be held as a reserve currency while there is an expectation that it will hold its value. But Trump’s policies of increased tariffs and increased budget deficits mean that it is quite likely that US inflation and its current account deficit will deteriorate further, and that will in turn put downwards pressure on the US dollar.

Higher interest rates could help resist these inflationary and current account pressures. Indeed, in the last couple of months the yield on ten-year Treasury bonds has increased by about one percentage point and most recently the Federal Reserve has stopped giving any indication that it expects further interest rate cuts. But these higher interest rates will also come at a cost to American living standards and full employment.

Furthermore, the BRICS grouping of countries is expanding and they have decided to reduce their reliance on the US dollar in future. Thus, it is quite likely that that instead of America becoming great again, its dollar will be worth less, and inflation will accelerate further.

In sum, thanks to Trump’s delusional economics, many Americans will find themselves worse off in four years’ time than they are today. So much for MAKE AMERICA GREAT AGAIN! And the turmoil that Trump plans to introduce will also damage the world economy as well.

https://johnmenadue.com/trumps-economic-delusions/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

PLEASE DO NOT BLAME RUSSIA IF WW3 STARTS. BLAME YOURSELF.

meanwhile.......

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

PLEASE DO NOT BLAME RUSSIA IF WW3 STARTS. BLAME YOURSELF.