Search

Recent comments

- brainwashed tim....

2 hours 16 min ago - embezzlers.....

2 hours 22 min ago - epstein connect....

2 hours 33 min ago - 腐敗....

2 hours 52 min ago - multicultural....

2 hours 59 min ago - figurehead....

6 hours 7 min ago - jewish blood....

7 hours 6 min ago - tickled royals....

7 hours 13 min ago - cow bells....

21 hours 6 min ago - exiled....

1 day 2 hours ago

Democracy Links

Member's Off-site Blogs

the sinking economy of france.....

France's political crisis shows no sign of abating. The resignation of Sebastien Lecornu as prime minister this week, after just 27 days in office, means the country is set to have an eighth prime minister in the space of five years.

Although President Emmanuel Macron now looks set to name another prime minister before the week is over — potentially fending off the need for new elections — the political turmoil comes with major consequences for the EU's second-largest economy.

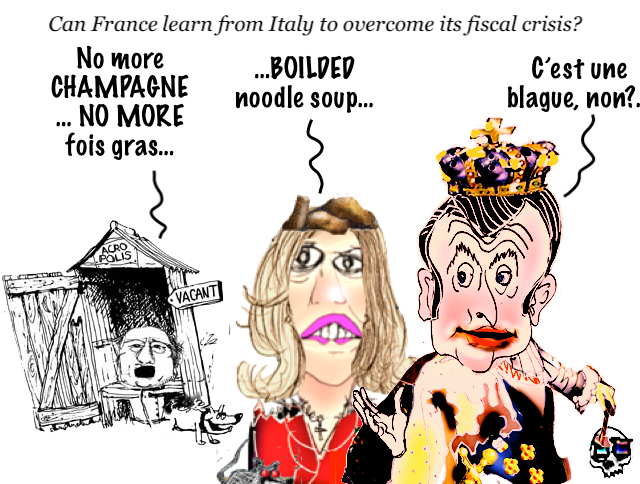

Can France learn from Italy to overcome its fiscal crisis?

BY Arthur Sullivan

France's political and economic crisis is deepening. Governments keep falling, budgets can't be agreed and the country's debt pile keeps expanding. Can it learn anything from reformed problem child Italy?

As happened in 2024, it means the 2026 budget may not be agreed in time to be debated and passed by the end of the year. Last year, the budget was "rolled over" into 2025 due to political instability, meaning the old budget was used until a new budget was finally agreed in February.

Although that short-term solution prevents the risk of a US-style government shutdown, it does nothing to deal with France's long-term economic problems, namely its debt and public finances.

The debt problemIn the aftermath of the latest prime minister resignation, rating agencies issued fresh warnings about France's underlying fiscal problems.

Fitch, which dropped France into a single A rating last month, said the political situation meant a resolution of the country's fiscal problems looked unlikely.

Meanwhile S&P Global emphasized the need for France to implement a budget which enabled it to comply with its EU treaty obligations, specifically referring to the fact that France has flouted the strict borrowing and debt rules from the EU's Stability and Growth pact for some time.

During Macron's period in office since May 2017, public spending has climbed significantly while he also brought in deep tax cuts. The country's national debt has increased by more than €1 trillion ($1.17 trillion) as a result, although that has been offset by a 30% increase in GDP growth in that time period.

A preferred measure by economists is debt as a percentage of GDP. France's has increased to 114% of GDP from a 101% figure in 2017. That's the third highest rate in the EU, behind Greece and Italy.

France has not balanced its budgets for decades and typically outstrips other OECD countries when it comes to public spending. However, recent crises such as the COVID-19 pandemic, Russia's war in Ukraine and a series of energy price shocks has led to a surge in spending which has led to ever wider budget deficits.

The deficit was 3.4% when Macron came into office but is now at 5.8% and has been rising. The ongoing political instability, which came after Macron called snap elections in the summer of 2024 in an attempt to stave off the right-wing National Rally (RN), has made grappling with the fiscal problems harder still.

Those elections led to an even more divided national parliament, with no political bloc holding an absolute majority — cementing the present instability.

Alexandra Roulet, an economist with INSEAD Business School, says the spending during the recent crises, combined with the tax cuts, are the main reasons behind the debt surge.

"These policies have proven disappointing in terms of their effects on the French budget," she told DW. "The hope was to spur investment and boost the economy in such a way that it would lead to a growth in fiscal revenue despite the decrease in the tax rate but we haven't seen this happening."

The Italian jobYet if the French political scene does eventually stabilize, some experts do see a model for it to follow in terms of getting its fiscal house in order — Italy.

Although its neighbor still has a higher debt-to-GDP rate than France, at 138%, Melanie Debono, senior Europe economist with Pantheon Macroeconomics, says the country's "fiscal situation has improved significantly in recent years," highlighting that its budget deficit has fallen to 3.4%, close to the prescribed EU rate of 3%.

Italian Prime Minister Giorgia Meloni recently announced that she expected Italy's deficit to fall to 3% of GDP this year, which would allow Rome to exit the EU's program for countries with excessive deficits earlier than expected.

Speaking with DW, Debono said the Meloni government has been "prudent," cutting construction bonuses and making efforts to collect unpaid taxes, while still managing to cut income taxes and business taxes.

She sees similarities in the Italian and French fiscal situations "in the sense that both suffer from structural challenges related to chronically high, and rising spending and future liabilities, and a weak supply side in the economy which is struggling to raise enough revenue to cover committed spending."

However, while the Italian situation has been improving, France's has been getting worse. "The French deficit has been widening alarmingly due to a continued rise in spending, and weakness in tax revenues," she said.

In terms of direct things France can learn from Italy, she thinks the different political systems don't allow for easy comparisons.

"It is not clear to us that the relative stability in Italy can be used as a guide for what France should do," said Debono. "France is not being helped here by the setup of the Fifth Republic in which the president and parliament easily can end up fighting each other when the latter does not have a majority to support the policy of the former."

However, she noted how Italy has managed pensions since the sovereign debt crisis in the early 2010s, raising the age by three months every two years, except in certain special years when the increase has been frozen.

France could follow this example, argued Debono, but highlights that Paris needs a lot more than pensions reform to get closer to the EU 3% target. "France needs radical spending cuts and/or tax increases."

https://www.dw.com/en/can-france-learn-from-italy-to-overcome-its-fiscal-crisis/a-74290513

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 11 Oct 2025 - 5:22am

- Gus Leonisky's blog

- Login or register to post comments

golden powers....

Italy ready to defend 'golden powers' against EU moves, economy minister says

By Giuseppe Fonte

ROME (Reuters) -The Italian government will defend its golden powers aimed at shielding strategic assets, its economy minister said on Friday, as Brussels prepares to challenge the legislation.

Italy is among the EU countries that have made extensive use of golden power legislation to protect interests in sectors such as banking, defence and telecommunications.

Minister Giancarlo Giorgetti told reporters in Luxembourg national security was not for European institutions to judge.

"National security is the exclusive responsibility of the national government, and we intend to defend it in some way," he said at the end of a meeting between European finance ministers.

Reuters reported on Thursday the European Commission was set to act against Rome as part of a push against EU countries hampering bank consolidation in Europe.

Brussels will launch two separate legal proceedings under single market and merger rules respectively, the sources said.

The move was prompted by Italy's intervention in a proposed bank merger involving the country's second-biggest lender UniCredit, which withdrew its offer for smaller rival Banco BPM on July 22, blaming government interference.

Among several conditions for the deal to proceed, Italy had told UniCredit to halt activities in Russia by early 2026, to prevent savings collected by Banco BPM from funding Moscow's war against Ukraine. Rome kept this decree in place despite the collapse of the deal.

The EU will order Italy to withdraw the decree that set terms for UniCredit's failed bid, the sources have said, while challenging the overall golden power legislation through a separate infringment procedure.

"When the EU's remarks will arrive, We will evaluate them. I am simply saying that the Government is applying an effective law. If you want to change the law, it is up to Parliament to do so," Giorgetti said when asked about the Reuters report.

The EU Commission plans to send two separate letters to Italy by mid-November to start its move, the sources added.

If the EU rules that the conditions imposed on UniCredit are unlawful, UniCredit will be able to assess whether to seek damages from Italy.

Giorgetti, however, signalled the government was ready to challenge the proceedings in an EU court.

https://www.globalbankingandfinance.com/italy-banks-eu-two

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

The Institutional Framework: Golden Power vs. EU Integration

Origins and Evolution of Golden Power

Italy’s golden power legislation originated in 2012 as a defensive mechanism against unwanted foreign acquisitions of strategic assets. Initially designed to protect critical infrastructure and defence-related companies, the scope expanded dramatically during the COVID-19 pandemic when asset valuations crashed and governments feared opportunistic foreign acquisitions.

The legislation grants the Italian government extraordinary powers to:

Block foreign acquisitions entirely

Impose conditions on transactions

Require divestments of specific assets

Mandate operational restrictions

déjà-vu....

France's reappointed PM Sébastien Lecornu faces immediate budget challenge

French Prime Minister Sébastien Lecornu, freshly reappointed late on Friday just days after resigning, faces a race against the clock to deliver a 2026 budget bill by Monday and attempt to sway a fractious parliament, with opponents on the left and the far right already vowing to shoot down his new cabinet.

French President Emmanuel Macron on Friday named Sébastien Lecornu as prime minister, reappointing him after he quit the job earlier this week, hoping the loyalist can draw enough support from deeply divided parliament to pass a 2026 budget.

In naming Lecornu, Macron, 47, risks the wrath of his political rivals, who have argued that the best way out of the country's deepest political crisis in decades was for Macron to either hold snap parliamentary elections or resign.

READ MORE:

https://www.france24.com/en/france/20251010-i-accept-out-of-duty-macron-asks-outgoing-pm-lecornu-to-try-again-to-form-government

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.