Search

Democracy Links

Member's Off-site Blogs

Blogs

beneath the star spangled banner .....

Today, in New York City, the US is torturing a Muslim detainee with no prior criminal record who has not even gone to trial.

- By John Richardson at 6 Apr 2010 - 8:36pm

- John Richardson's blog

- Login or register to post comments

- Read more

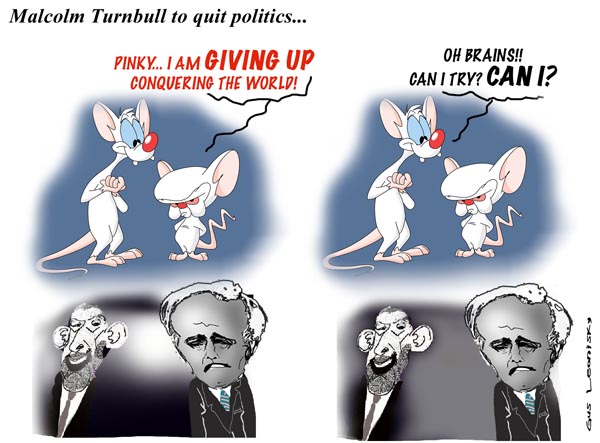

life beyond the toons...

Mr Abbott was generous in his praise of Mr Turnbull.

"In just two terms, Malcolm has scaled the commanding heights of Australian politics,’’ a statement from Mr Abbott read.

‘‘Malcolm has brought to all his public roles extraordinary determination, considerable personal charisma and great intellectual consistency.

"Personally, I have enjoyed his friendship since university days and look forward to doing so for many years to come."

- By Gus Leonisky at 6 Apr 2010 - 1:08pm

- Gus Leonisky's blog

- 7 comments

- Read more

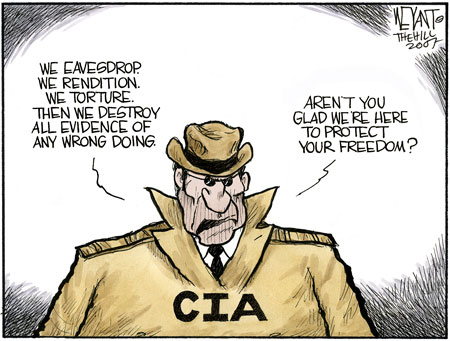

dusty foggo & co .....

It is hard to summarize Tim Weiner's Legacy of Ashes because there really isn't anything that can be cut from it. Every page is packed with stories of incredible sacrifice at low levels and incredible malfeasance at the highest level (low-level people thinking of sacrificing yourselves, take note).

- By John Richardson at 4 Apr 2010 - 2:21pm

- John Richardson's blog

- 4 comments

- Read more

feral police .....

There they go again, our very own Keystone Kops. The Australian Federal Police have bungled yet another ''anti-terrorist'' investigation. The fiasco finally came crashing down around their ears in the Victorian Supreme Court on Wednesday. To cut a long story very short, three prominent members of the Australian ethnic Tamil community - all Australian citizens - had been charged with acts of terrorism in support of the Tamil Tiger rebellion in Sri Lanka.

- By John Richardson at 3 Apr 2010 - 10:46am

- John Richardson's blog

- 5 comments

- Read more

psycho sam .....

After eight years imprisonment without charge or trial, five former Guantánamo prisoners are beginning new lives this week - two in Switzerland and three in Georgia.

Their stories reveal, yet again, how Republican lawmakers and media pundits in the US, who have, in recent months, renewed their fear-filled attacks on those still held, are guilty of hyperbolic and unprincipled outbursts and, in addition, how these critics' attacks are damaging to the prospects of cleared men, seized by mistake, finding new homes in countries that, unlike the US, are prepared to offer them a chance to rebuild their shattered lives on a humanitarian basis.

- By John Richardson at 3 Apr 2010 - 10:03am

- John Richardson's blog

- 3 comments

- Read more

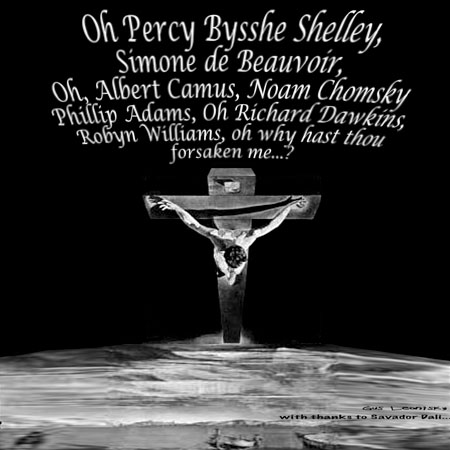

of false crusades...

Religious leaders have used their Good Friday sermons to launch an attack on what they call a recent surge in atheism.

Thousands of Christians crowded into churches this morning to mark the solemn Christian festival of Good Friday.

Sydney Anglican Archbishop Peter Jensen told his congregation atheism is not the rational philosophy that it claims to be.

Dr Jensen told the congregation that atheism is as much of a religion as Christianity.

- By Gus Leonisky at 3 Apr 2010 - 8:34am

- Gus Leonisky's blog

- 50 comments

- Read more

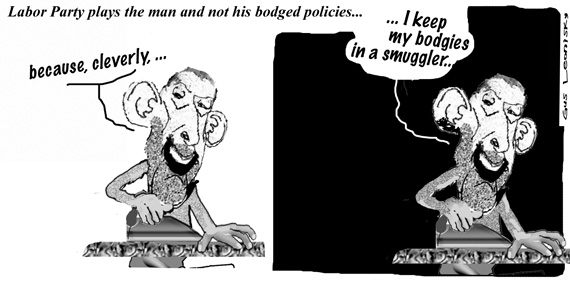

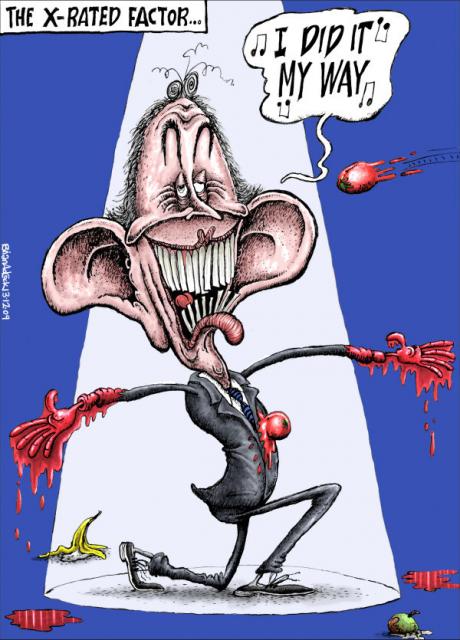

mr negativity...

Mr Abbott blamed the Labor Party for the focus on his persona rather than policies.

"What we are seeing is an orchestrated campaign from the Labor Party to try to play the man and not the ball," he said.

"We saw a classic case of this on the weekend, you had the prime minister tweeting best wishes to me as I was involved in a major community event while you had his ministers out there, in what was plainly an orhcestrated way, suggesting that there was something wrong with a senior politician competing in a triathlon."

- By Gus Leonisky at 2 Apr 2010 - 8:41am

- Gus Leonisky's blog

- 2 comments

- Read more

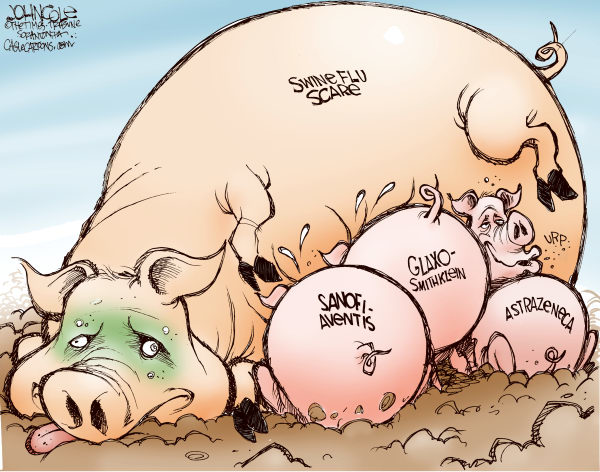

crying wolf .....

The World Health Organisation is to set up an independent panel to investigate charges that it exaggerated the impact of the H1N1 swine flu pandemic and is unduly influenced by the pharmaceutical industry.

- By John Richardson at 1 Apr 2010 - 8:17pm

- John Richardson's blog

- 8 comments

- Read more

the war on peace .....

Without public debate and without congressional hearings, a segment of the Pentagon and fellow travellers have embraced a doctrine known as the Long War, which projects an "arc of instability" caused by insurgent groups from Europe to South Asia that will last between 50 and 80 years. According to one of its architects, Iraq, Afghanistan and Pakistan are just "small wars in the midst of a big one."

- By John Richardson at 1 Apr 2010 - 8:14pm

- John Richardson's blog

- 10 comments

- Read more

selling out...

- By Gus Leonisky at 1 Apr 2010 - 6:09pm

- Gus Leonisky's blog

- 3 comments

- Read more

mister magic .....

The newspapers are full of the latest priestly sex abuses. This is an on going story. Within the last year, mass scandals have erupted in Brazil, Australia, Canada, Ireland, Italy, Germany, the Netherlands, Switzerland, Austria. and the United States. Figures from the John Jay School of Criminal Justice estimate that since 1950, an estimated 280,000 children have been sexually abused by Catholic Clergy and deacons.

- By John Richardson at 31 Mar 2010 - 7:07pm

- John Richardson's blog

- 6 comments

- Read more

in ironic water...

From the ABC

Nationals Senate leader Barnaby Joyce says comments he made yesterday poking fun at the Productivity Commission were meant to be ironic.

In his new role as Opposition spokesman for regional development, infrastructure and water, Senator Joyce has been quick to have a crack at the Government.

But already he has had to qualify his comments.

Yesterday he joked that he used Productivity Commission reports when he runs out of toilet paper.

"These people actually did read the Productivity Commission reports," he said. "I use them when I run out of toilet paper, but they actually use them."

- By Gus Leonisky at 31 Mar 2010 - 9:13am

- Gus Leonisky's blog

- 7 comments

- Read more

climate villains .....

Earlier this week, Greenpeace did the rational world a huge favor by compiling a great overview of the denial industry. "Dealing in Doubt: The Climate Denial Industry and Climate Science" is a brief but critical summary of the attacks on climate science, scientists and, most notably, the IPCC.

- By John Richardson at 29 Mar 2010 - 9:02pm

- John Richardson's blog

- Login or register to post comments

- Read more

The ultimate challenge...

Rattled Rudd in fear, says Abbott

STEPHANIE PEATLING POLITICAL CORRESPONDENT

KEVIN RUDD is ''rattled'' by the Coalition's resurgence and ''is in fear of his political life'', Opposition Leader Tony Abbott says.

- By Gus Leonisky at 29 Mar 2010 - 7:59am

- Gus Leonisky's blog

- 1 comment

- Read more

"aussie tony" & the value of front .....

Here in the States when someone mentions "UI," most of us think of Unemployment Insurance, but not former UK prime minister, Tony Blair.

Late last week came word of a major scandal from the UK Daily Mail. In the three years since he stepped down as prime minister, Blair pocketed more than $30 million in oil revenues from his secret dealings with a South Korean oil consortium, UI Energy Corporation. Despite all his best efforts to keep his connection to UI secret, word is spreading like wildfire throughout the U.K.

- By John Richardson at 28 Mar 2010 - 8:58pm

- John Richardson's blog

- Login or register to post comments

- Read more

Recent comments

42 min 38 sec ago

5 hours 10 min ago

5 hours 14 min ago

5 hours 47 min ago

5 hours 57 min ago

6 hours 13 min ago

13 hours 19 min ago

14 hours 48 min ago

14 hours 52 min ago

16 hours 9 min ago